We are now entering a critical period for tech stocks. Around one-third of the tech-heavy Nasdaq 100 reports in the coming days.

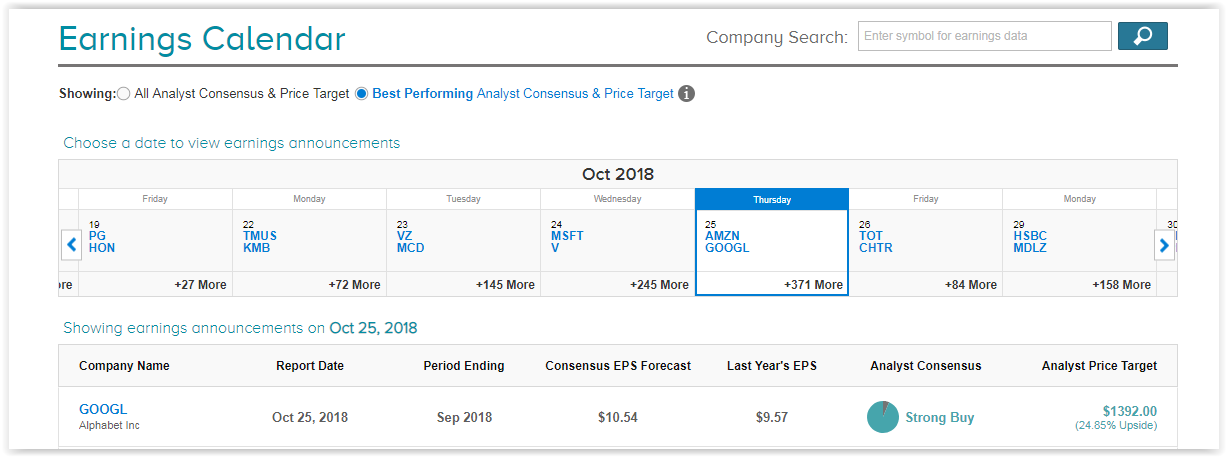

This nifty calendar enables you to find stocks with upcoming earnings that have a ‘Strong Buy’ rating from the Street’s best-performing analysts. As well as the stock’s consensus rating, you can also filter by market cap and sector.

As you can see below, simply clicking on the date reveals the stocks which match your criteria- in this case ‘Strong Buy’ tech stocks. And most importantly, you can also see the upside potential from the current share price to the average analyst price target. This gives us a valuable indication of the stock’s growth potential for the coming months. The result: you don’t need to waste precious time analyzing stocks with little upside ahead.

With that in mind, let’s take a closer look at three particularly compelling stock picks here:

Alphabet: A Bargain Buy Even At $1,115

The crunch date for this Internet giant is upon us. Alphabet (GOOGL – Research Report) is set to report its earnings results October 25. For the print analysts are anticipating $34.05B gross revenue, $25.31B net revenue, and $10.45 GAAP EPS.

“Amazon’s up about 50 percent this year, Microsoft is up about 30 percent, Google is only up about 5 percent this year, and I think it’s a great buy right now,” Strategic Wealth Partners’ CEO Mark Tepper told CNBC on October 19.

This sentiment is clearly reflected across the Street. Five-star Monness analyst Brian White (Track Record & Ratings) has just reiterated his Buy rating on GOOGL. He sees shares surging 27% to $1,415.

“Alphabet’s stock is inexpensive” concurs White, adding that the company continues to demonstrate impressive innovation. He is confident that GOOGL can hit the targeted 23% growth since last quarter, with EPS of $10.74- placing him above the Street (at $10.45).

Leave A Comment