Biotech stocks have had a good year so far. Not a blistering rise, but nonetheless a steady rise. Of course, one expects even stronger performance on a relative basis from a higher-risk sector, particularly when the overall market continues to record all-time highs. Perhaps such out-performance is reserved for 2018.

Biotechs entered the year with a burden of a -21% decline in 2016, as represented by the Nasdaq Biotechnology Index ETF (IBB), and a shroud of drug price policy uncertainty that sapped energy from the sector. In our 2017 outlook, we had discussed a few reasons which made biotechs attractive for the year. Things turned out fairly well, keeping in mind the intensely negative backdrop at the time, as the Nasdaq Biotechnology Index rose nearly 20% as of early December 2017. This is after a 10% correction since October, which presented an attractive opportunity as was highlighted in our earlier article, Opportunity Ahead.

We believe 2018 will be a positive year for biotechnology and we will witness record new all-time highs. We list our reasons for optimism below.

Diminished Risk of Draconian Policy Announcements

The relentless pressure of being the whipping boy for drug price increases and the ensuing risk of drug price regulation has subsided to a significant extent for biotechs and pharmaceuticals (Biopharma).

Investors may recall that both these groups have been under a cloud of regulatory uncertainty since late 2015 as highlights of egregious price increases by a few firms dominated the public and political health care debate. The industry in response has been spurred towards greater self-regulation as leading firms pledged to restrain price increases in an effort to shift the debate towards the tremendous health care benefits of the biopharma industry. And there is a lot more great science to come.

Furthermore, the administration articulated its policy initiative in July 2017 through an Executive Order to reduce drug prices. Some of the strategies being pursued include process improvements to accelerate the drug approval process, as well as expediting approval of generics by updating the regulatory and reimbursement processes along with offering incentives for generic drug manufacturing. There was no attempt to create a regime of price regulation through the Centers for Medicare and Medicaid Services.

In the meantime, the latest inflation report indicates that prices of medical commodities, such as prescription drugs, rose 0.6% in November and were up 1.8% from a year ago, a historically mild rise that is contributing to curtailing overall inflation in the economy. Perhaps greater awareness and self-regulation have already begun to make some early impact.

At this time, drug price regulation is a diminishing risk and that too more of a political rhetoric one, which will be evident particularly around election times, than an actual policy risk. An easing of such pressure continues to assist the healthcare (XLV) sector. From the standpoint of the prevailing mindset, it appears we have come a long way from the reference by Trump of the “industry getting away with murder.”

Biotechs will enter 2018 with the wind in its sails, rather than an albatross around its neck like 2017 began.

FDA Speeding Up the Drug Approval Process

New and Generics – Favor Both Industry And Politics

The US Food and Drug Administration (FDA) has been placed at the center of the price-cutting effort by the administration. This places great responsibility on the agency to drive efficiencies. The FDA has already embraced the new mandate and its actions have begun to accelerate the drug approval process.

This is a paradigm change and a highly favorable one that will continue to pay dividends for biopharma.

The FDA presently has four expedited programs to speed the development and review of drugs:

(1) Priority Review in 6 months (vs 10 months for standard review),

(2) Accelerated Approval based on surrogate measures, while

(3) Fast-track, and

(4) Breakthrough Therapy programs are both focused on reducing the duration of clinical trials.

In a research article titled, FDA’s Expedited Programs and Clinical Development Times for Novel Therapeutics, 2012-2016, published in JAMA, it was indicated that a median time for development in any of these expedited programs was 7.1 years compared to 8 years for a non-expedited drug.

Shrinking the timeline, even by a few months, can mean earlier patient relief and saving millions in new drug development and healthcare costs.

Since May 2017, the FDA under the leadership of Commissioner Scott Gottlieb has focused on streamlining the approval process and pursuing the initiatives outlined in the Executive Order.

In late June 2017, the FDA announced a strategic plan to eliminate the existing Orphan Drug backlog of ~200 drugs within 90-days, as well as responding to new requests for such a designation within 90-days of receipt of the application.

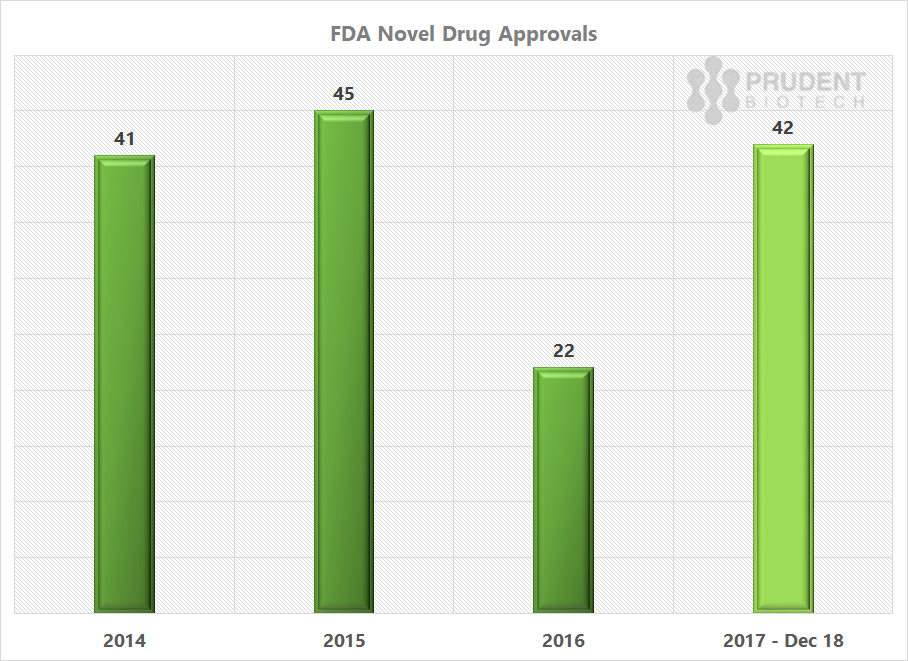

The FDA new or novel drug approvals for 2017 are much ahead of the 2016 pace, and similar to what was achieved in 2015 and 2014.

Source: FDA

In June, the FDA took steps to increase generic competition by releasing a list of pharmaceuticals with expired patents and limited or no competition, as well as prioritizing the review of abbreviated new drug applications (ANDAs) for which there are fewer than three ANDAs approved.

Leave A Comment