The spread between long and short Treasury yields has been narrowing lately, a change that some analysts see as a warning sign for US economic growth. The current numbers overall suggest that that the macro trend is sliding into the business-cycle ditch, but there’s still plenty of concern about painfully slow growth. How slow can it go before tipping into a formal recession? No one really knows, but the flatter yield curve these days is attracting attention in the wake of wobbly equity prices and mixed economic news.

“The yield curve itself signals that things are not good looking into the future and talking about recession risk,” Steve Major, head of fixed-income research at HSBC Holdings, tells Bloomberg. “The market is now ready for a long, long time with very low rates and it’s been painful because people have been expecting the Fed to do what it said it was going to do. The Fed really wants to hike rates but can’t.”

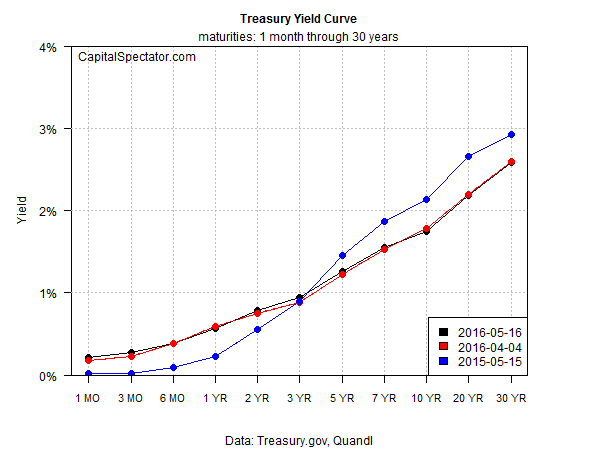

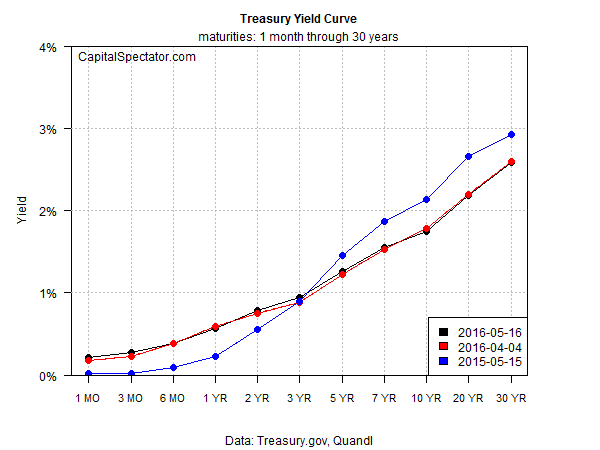

Divining the future path for the economy is loaded uncertainty, as always, but the big squeeze on the yield curve lately is still noticeable and somewhat worrisome, based on daily data via Treasury.gov. Note, for instance, how yesterday’s curve (black line) compares with its shape from a year ago (blue line). Maturities for five years and above have dropped while shorter term yields—2 years and below—have increased. The net result: the spread between short and long rates has been squeezed.

Squeezed but not inverted. The yield curve remains positively sloped, albeit less so compared with recent history. Nonetheless, there’s still a ways to go before we see an inversion, which is to say that yields aren’t predicting a recession at the moment. When/if the curve inverts, the change will trigger a widely respected signal that a new contraction is near. But long yields are still comfortably above short rates and so it’s premature to assume the worst.

The recent histories for the 2- and 10-year yields also paint less-threatening profiles vs. looking at changes in the shape of the entire curve. Although yields have fallen after the recent peaks in late-2015, Treasury rates have been relatively stable in the second quarter, albeit at moderately lower levels.

Leave A Comment