The Q4 earnings season has turned out to be fairly good. Not only is growth on track to be the highest in two years, but total earnings for the quarter are also on track to be a new quarterly record.

Please recall that earnings growth turned positive only in 2016 Q3, having declined in each of the preceding 5 quarters, as the chart below of year-over-year earnings growth for the S&P 500 index shows.

Importantly, the positive Q4 growth isn’t a result of easy comparisons, but actually a function of strong gains in actual earnings. In fact, the overall tally of Q4 earnings for the S&P 500 index is on track to reach an all-time record for the index, surpassing the previous record achieved in 2014 Q4. The chart below shows the quarterly earnings totals for index, contrasting the highlighted Q4 tally with actual results from the last 8 quarters and expected tallies in the coming 4 quarters.

As you can see, this record isn’t expected to last very long, with growth expected to ramp up notably in the coming quarters.

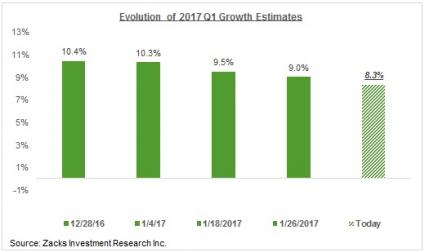

One other positive for this earnings season is the relatively modest negative revisions to current-quarter (2017 Q1) estimates; they have come down, but not by as much as has historically been the case. The chart below shows evolution of Q1 estimates since the start of the period.

Q4 Scorecard (as of February 3, 2017)

We now have Q4 results from 275 S&P 500 members, or 55% of the index’s total membership. With 84 index members on deck to report results next week, we will have seen Q4 results from 71.8% of the index’s total membership by the end of next week.

Total earnings for these 275 index members are up +6.9% on +4.2% higher revenues, with 68% beating EPS estimates and 54.5% coming ahead of top-line expectations.

The table below provides the current Q4 scorecard

The charts below provide a comparison of the results thus far with what we have seen from this same group of 275 S&P 500 members in other recent periods.

Leave A Comment