The term bear market rally is one that has been used with great enthusiasm over the last month. Many believe that the recent uphill climb in the market is due to a sharp rebound as a result of oversold conditions rather than an intermediate or long-term investable bottom. Bear market rallies are often characterized as short, violent bounces that will ultimately lead to a re-test or break of the prior lows.

A good client of mine recently sent me an excerpt from a podcast with Louise Yamada, the former head of technical research for Citigroup and prominent market technician. Louise made some very insightful statements that detailed why she believes we are in the final stages of a bear market rally.

I certainly have no evidence to disprove her theory and agree we could very well see the stock market roll over in the near future. I think that most investors would acknowledge we have moved from oversold to overbought during the month of March and there is likely going to be at least a modest dip from current prices. This would work off some of the overbought momentum and create a more attractive entry point for new capital.

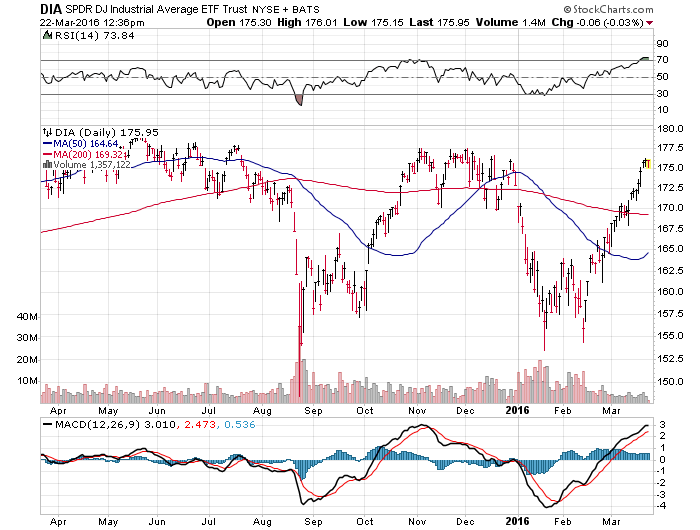

The symmetry of the 2015 correction and the one that has unfolded this year is also notable on many of the major indices. A chart of the SPDR Dow Jones Industrial Average ETF (DIA) below highlights this pattern.

In my opinion, the bigger problem with labeling the current ramp a bear market rally is that you confront two issues over time:

Leave A Comment