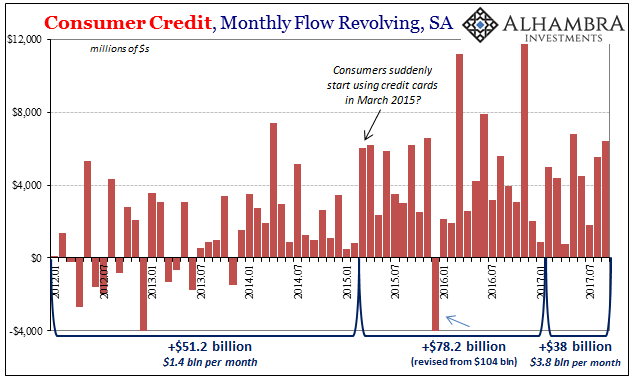

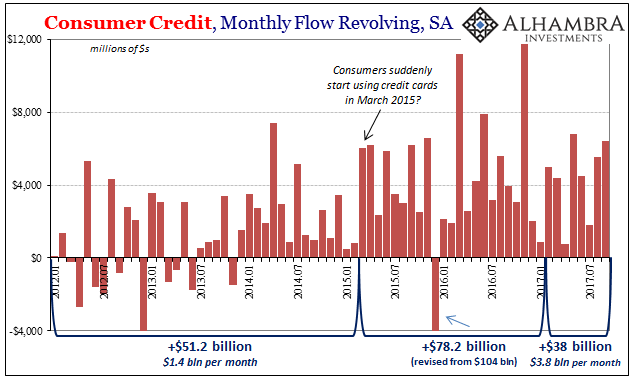

Federal Reserve revisions to the Consumer Credit series have created some discontinuities in the data. Changes were applied cumulatively to December 2015 alone, rather than revising downward the whole data series prior to that month. The Fed therefore estimates $3.531 trillion in outstanding consumer credit (seasonally-adjusted) in November 2015, and then just $3.417 trillion the following month.

Of that $114.3 billion revised away, the vast majority, $89.3 billion, came out of non-revolving credit balances. Revolving credit was reduced by a little over $25 billion.

Despite that discontinuity, revolving consumer credit growth remains elevated at least when compared to before March 2015. Post revisions, credit growth is obviously less than what the Fed calculated before them, but there remains a clear increase in revolving balances going back to when the “rising dollar” downturn turned more serious.

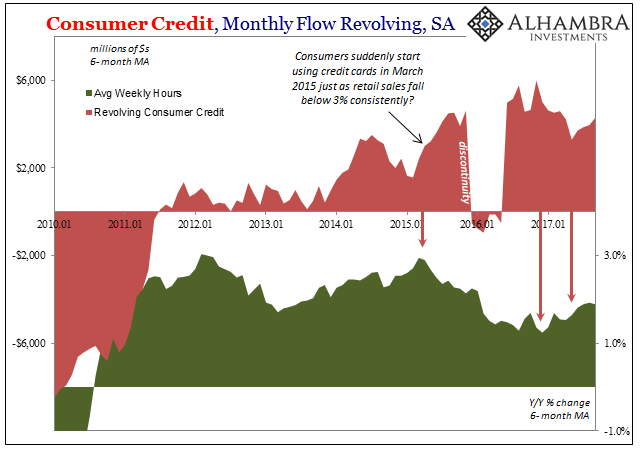

That shift matches up very well with separate data provided by the BLS on the labor market slowing. It, too, began around the same time, a correlation that isn’t surprising given the continually weak state of workers and therefore consumers.

The inverse relationship has continued through the “reflation” earlier this year, where at least total hours picked up at the end of last year suggesting some relative, if ultimately minor, improvement in the labor market. At the same time, revolving credit usage dropped off to a noticeable degree.

Going back to around May, however, revolving credit balances have been accelerating again just as the labor market improvement at least indicated by hours worked seems to have stalled. Correlation is not causation, but it’s a reasonable inference in this case given that recent history.

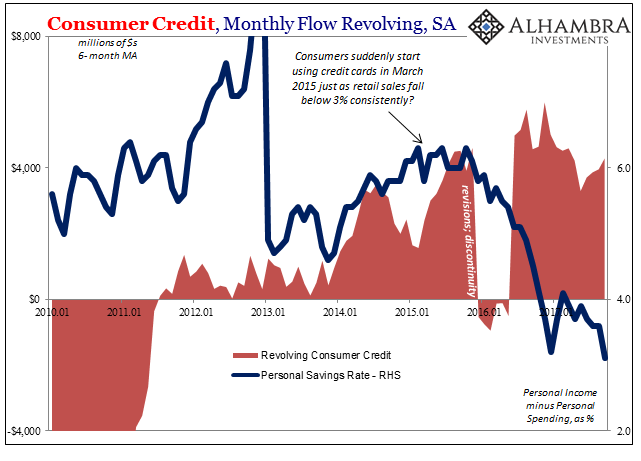

Both of these data series further match up well with the Personal Savings Rate that beginning in 2016 fell sharply. The combination of a falling savings rate and rising revolving consumer credit would usually signal the start or deepening of economic recovery to its fullest potential, but in this case the opposite condition appears far more likely.

Leave A Comment