The trend in consumer spending posted an encouraging profile during the last full month of the Obama administration’s tenure, prompting some analysts to reaffirm the case for another round of raising interest rates.

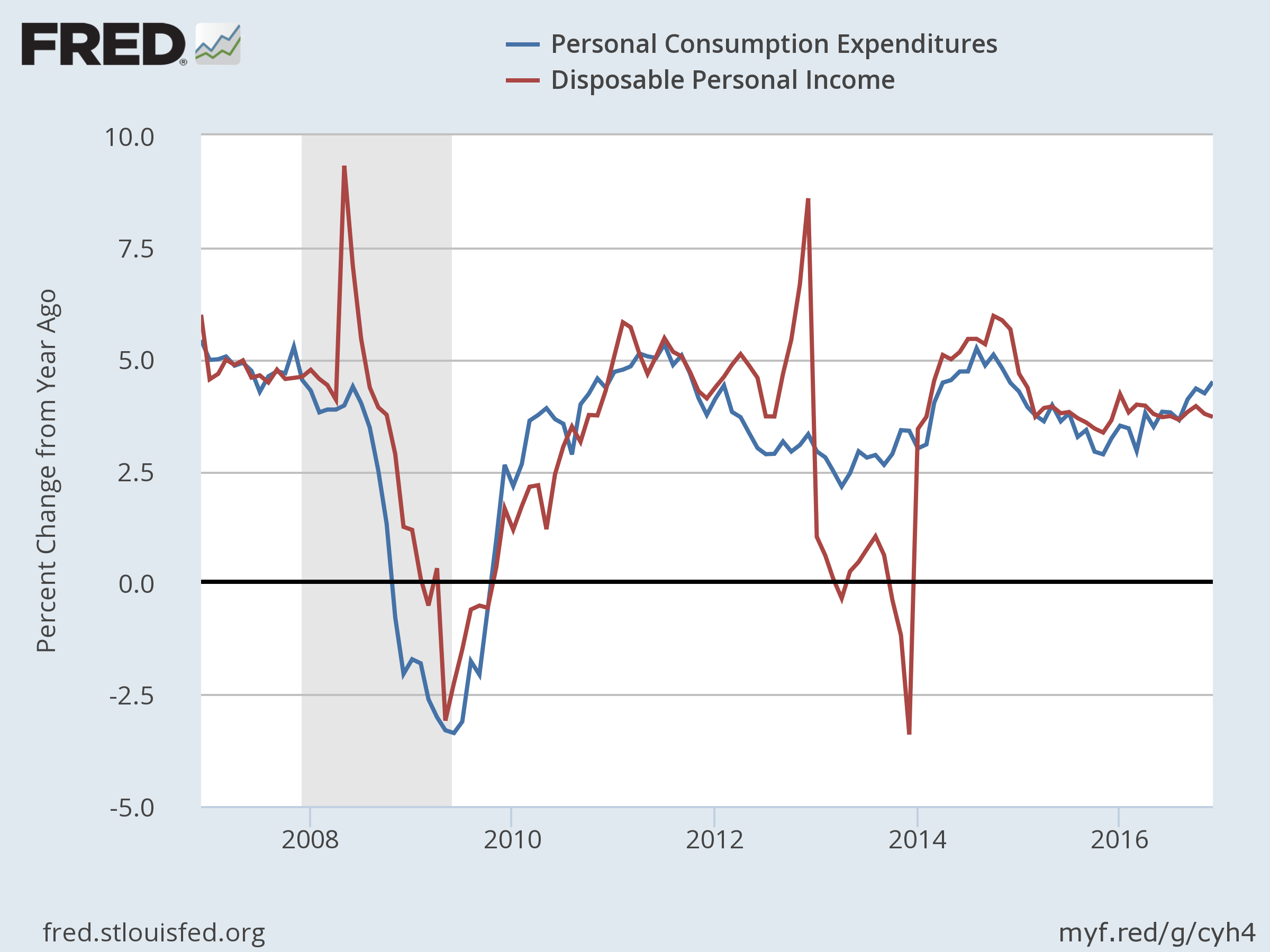

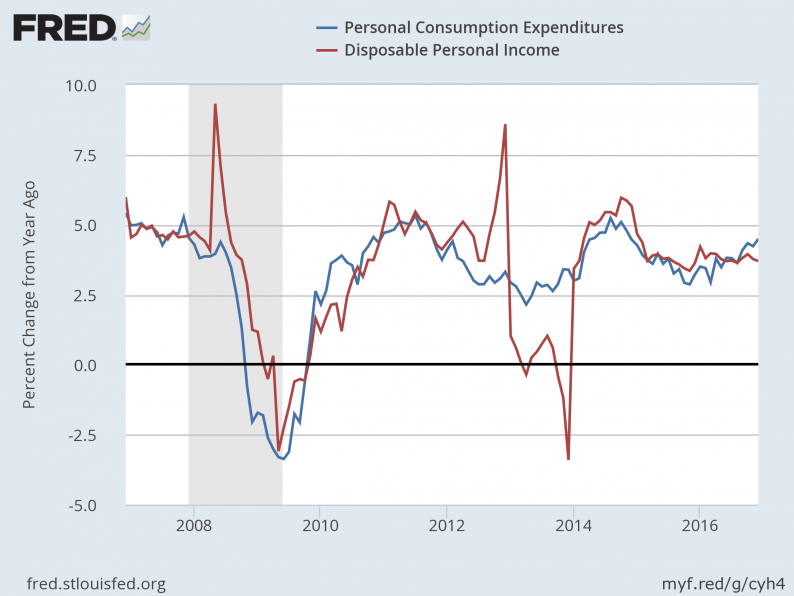

The year-over-year change for personal consumption expenditures (PCE) ticked up to 4.5% in December, according to the Bureau of Economic Analysis. That puts the annual trend for spending at the highest rate since Nov. 2014.

“Consumers keep on spending to help the economy grow and inflation is stirring,” says Chris Rupkey, chief economist at MUFG Union Bank. “The economy is at full employment. Time for the Fed to hoist sail on interest rates.”

The numbers for personal income, however, offer a counterpoint. While the year-over-year change for PCE continues to accelerate, the equivalent comparison for disposable personal income (DPI) was generally flat in 2016. DPI increased 3.7% for the year through December, which is close to the slowest pace recorded for last year.

DPI data can be volatile at times and so it’s wise to focus on the trend over several months. But even by that standard, recent history offers a cautious view. It’s too soon to know if DSPI’s flatlining will bring new headwinds for consumer spending, although a weaker trend for income in the months ahead would be worrisome after a year of treading water.

In fact, the case for deciding if US economic growth will pick up in the new year is a bit murky at the moment. The Atlanta Fed’s GDPNow model is currently projecting a mildly firmer trend in the first quarter. But the Jan. 30 estimate for a 2.3% rise in GDP in Q1 is only marginally better than the sluggish 1.9% advance reported for Q4.

The positive spin on the Q4 GDP trend is that the year-over-year change remains par for the course in terms of the economy’s history since the recession ended in 2009. Output is strong enough to keep recession risk low, but it’s debatable if the economy is poised to heat up.

Leave A Comment