Borrowing money to get something that a person wants today can be financially rewarding. For example, mortgage debt helps a borrower acquire a home that is likely to appreciate in value over time. Not only does one enjoy the use of the property, one often increases his/her net worth through the use of leverage.

A problem might develop, however, if an individual or family struggles to make the monthly payment. Job loss, sickness, ill-advised spending habits – a lendee might pay the bill later and later. The pattern of delinquency may worsen until, ultimately, a borrower may fail to repay altogether. Delinquency is often a precursor to default.

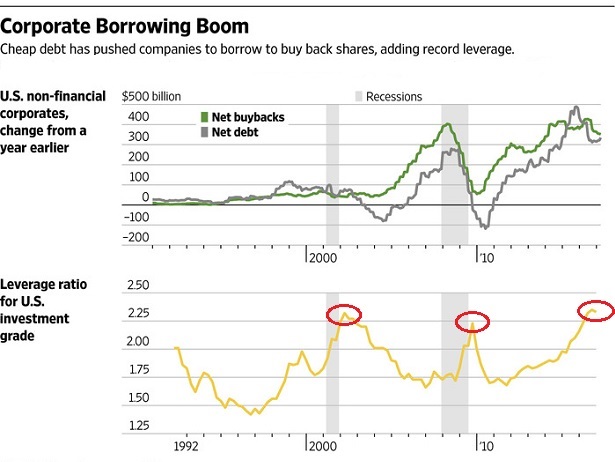

Now consider what is transpiring in today’s corporate environment. Companies across the globe could not resist the siren’s song of borrowing money at ultra-low rates. The bulk of the debt should have been used to finance business operations. In that manner, increasing debt without increasing equity might have been beneficial, as it likely would have contributed to longer-term growth.

Unfortunately, scores of company executives focused on shorter-term victories. How so? They “invested” the lion’s share of borrowed dollars in acquiring stock shares to inflate respective corporate stock prices, rather than invest significant capital in land, buildings, equipment, R&D and human resources.

The chart above, courtesy of the Wall Street Journal, shows how companies have piled on the debt (and the leverage) throughout the 8-year economic recovery. Even the least indebted corporations (a.k.a. “investment grade”) are operating with more leverage than they did back in the 2000-2002 stock bear or the 2008-2009 financial crisis.

Adding excessive debt during economic expansions may seem like a “no-brainer,” yet an adverse breeze could quickly push companies to the brink. Oil-n-gas companies that binged became delinquent when the industry toiled (2015-2016). Some have since defaulted. Similarly, brick-n-mortar retailers that borrowed as though a future day of reckoning would not occur are hitting the delinquency skids right now. This is not the case for brick-n-mortar retailers that kept debt modest from the get-go, even as sales might have been anemic.

Leave A Comment