Although sentiment towards European equities has improved since I wrote about it last Fall (pretty sure I am alone in this trade), this opportunity is not something that will be quickly arbitraged away. Not only that, but deep down, investors are still skeptical about the long term prospects for European equities. Sure, they are willing to surf European equities for a wave or two, but ask them where they are willing to invest for the long haul, and Europe is rarely in the running as a top pick.

I understand their pessimism. Europe has a lot of problems. Poor demographics, an unstable political union, layers of bureaucracy, the list goes on and on. It’s tough to imagine Europe being a great place to park your money.

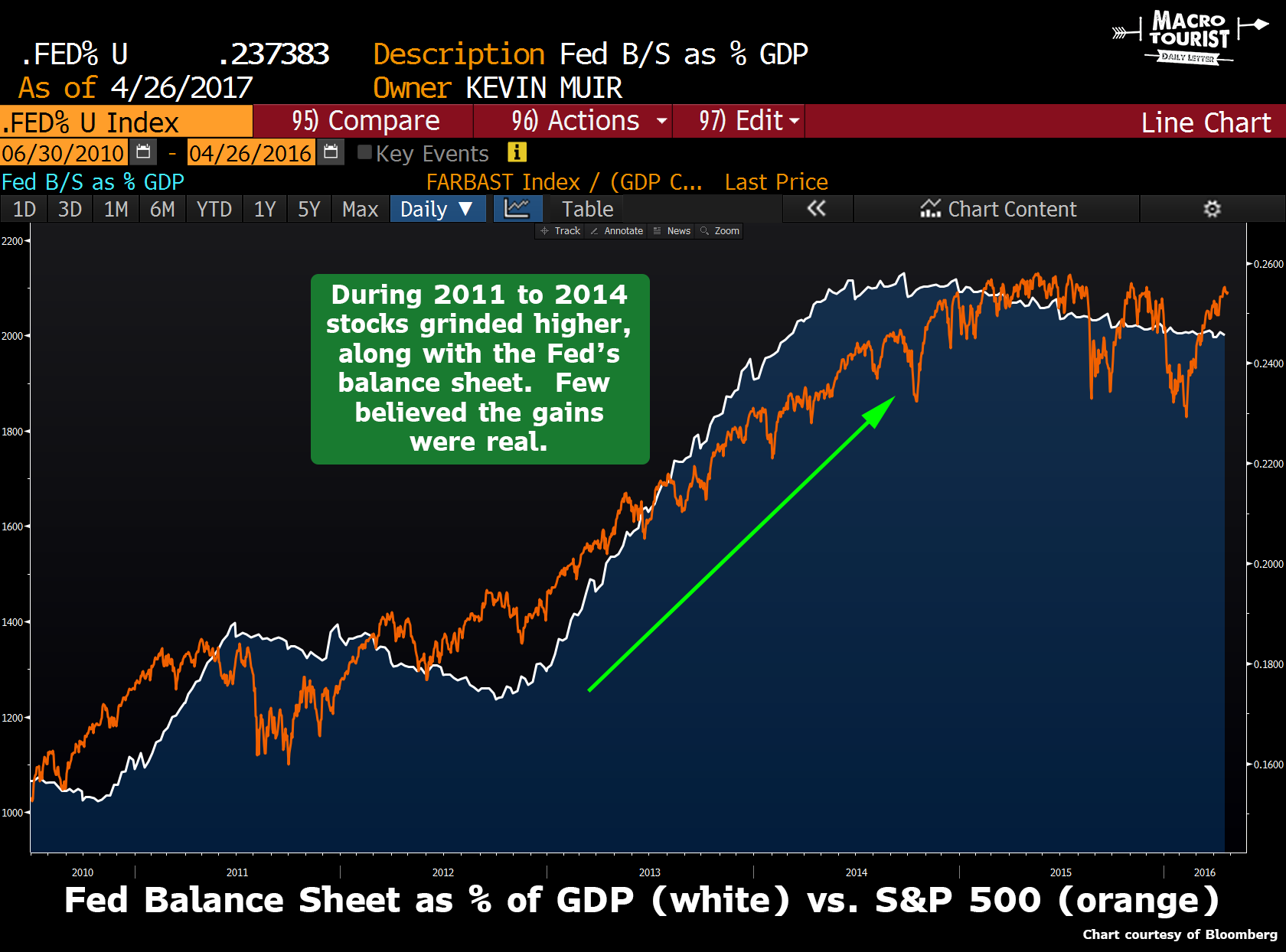

Yet too many investors mistakenly believe good old fashioned fundamentals still drive financial asset markets. Nothing could be further from the truth. Since the 2008 credit crisis, Central Bank flows have made a mockery of financial pricing theory.

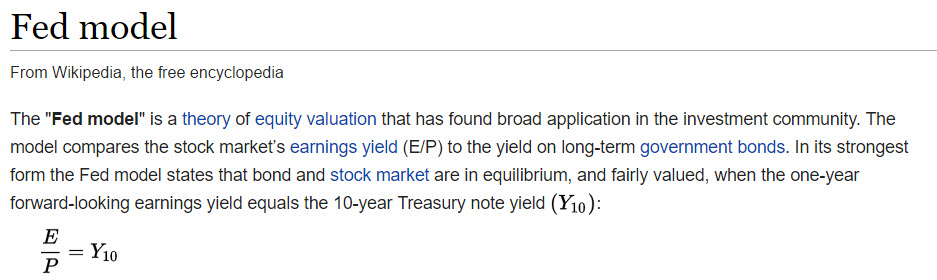

How do you determine the fair value of assets, when the risk free rate which most other assets are priced off, is negative?

Try putting negative yields (or even just tiny yields) into the Fed equation model and figure out the price for a stock index.

The current situation in Europe is remarkably similar to the U.S. period of 2010 to 2014. At that time, most investors were extremely negative about America’s prospects. Many investors called it a “sugar high” induced by the Fed’s continual balance sheet expansion. There were all sorts of forecasts of doom. Yet stocks kept climbing… and climbing.

The same thing will most likely happen in Europe. The ECB is aggressively expanding their balance sheet, and they have even pushed short term rates to absurdly negative levels. Their monetary policy is just bat sh*t crazy.

Lately the market has started to wake up to the relative cheapness of European equities, and there has been a pronounced swing from America to Europe. In fact, since the Trump election victory, European stocks have now outperformed American equities.

Leave A Comment