A few important things I’ve learned over the years:

1) The prevailing narrative always follows price.

2) Prices can be very wrong at times (the market is NOT always right).

3) When prices are wrong, narratives become nonsense.

4) Chasing nonsense (false narrative) is not an effective investing strategy.

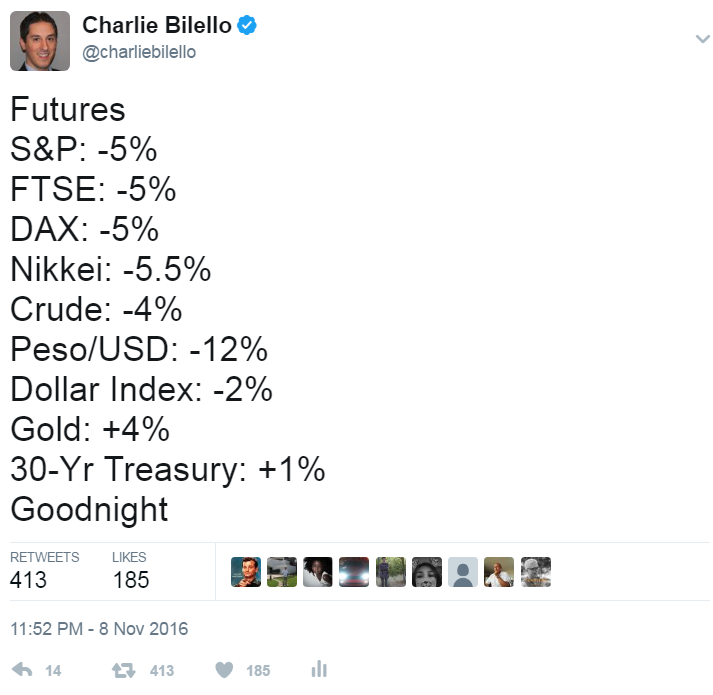

Just before midnight on election night last November, the narrative was decidedly bearish. The odds of a Trump win had surged higher, and doomsday prophesies piled in. What were they based on?

This, and this alone…

S&P 500 futures traded limit down, the Mexican Peso suffered its worst decline since the Tequila crisis in 1994, and safe haven trades (Treasuries and Gold) moved sharply higher.

“The markets are sending a clear message: Trump is bad for risk assets. All of them. Sell everything.”

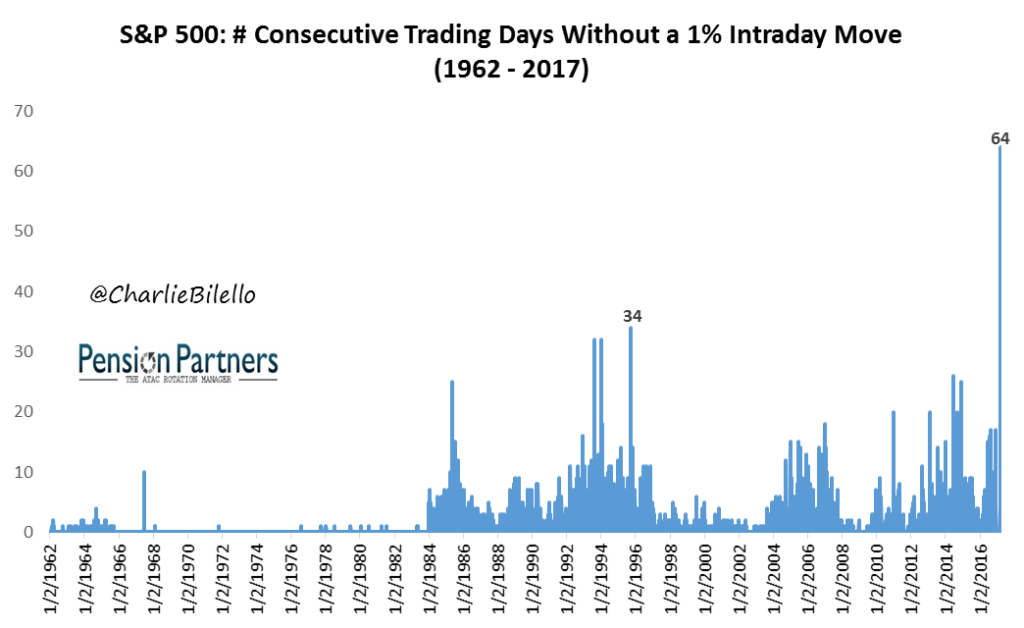

By the open the next morning, the narrative already started to change. The S&P 500 had recovered all of its overnight losses while Gold and Treasuries had given up all of their gains. A new narrative was formed: “Maybe Trump isn’t as bad for risk assets as we thought but there’s no possible way he can be good. The volatility over the last 10 hours is a clear sign of things to come. Expect record volatility in the coming months as the market comes to terms with his erratic tweets and more erratic agenda.”

What happened next? Naturally, instead of record high volatility, we saw record low volatility. The market has a tendency to inflict pain on maximum number of participants, and the pain trade for most participants at the time was a low volatility ramp higher. In the months that followed the election, investors would witness one of the most peaceful market ramps in history.

A month after the election, the market had come to terms with Trump’s “policies,” but not in the way anyone expected. Record short-term gains were seen in bank stocks (KBE), financials (XLF), small caps (IWM), and transports (IYT). At the same time, Treasuries were crushed (interest rates spiked), Gold (GLD) was slaughtered, the Dollar (DXY) surged higher, and Emerging Market stocks, bonds and currencies moved sharply lower.

Leave A Comment