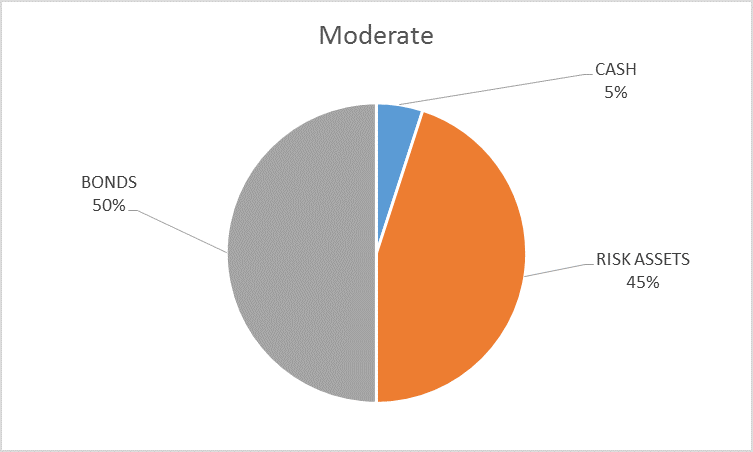

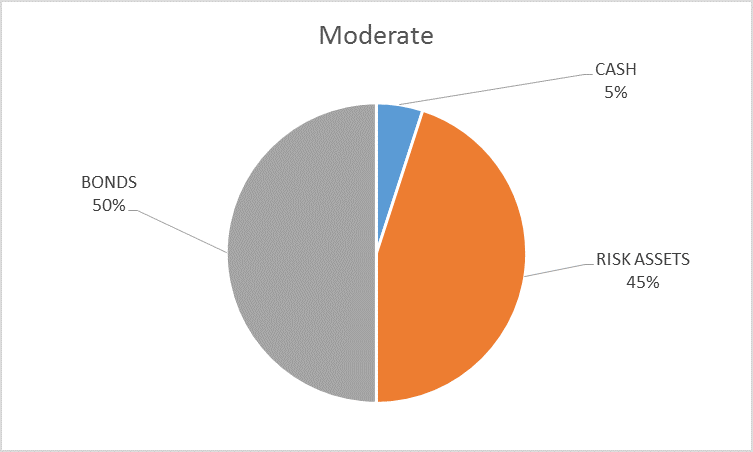

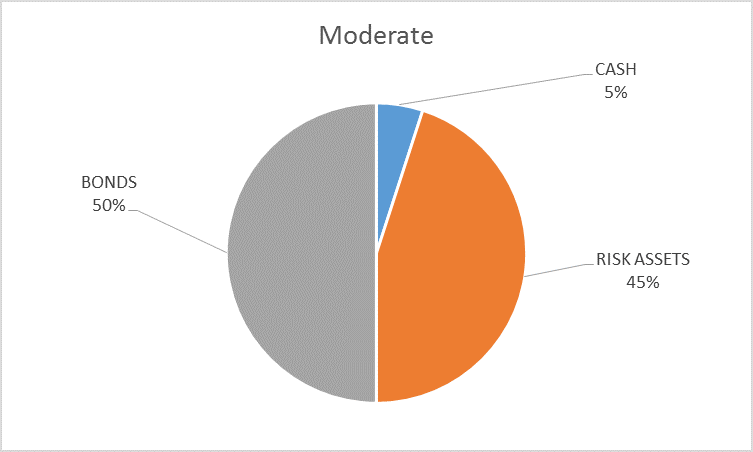

I am raising the budget for risk assets this month. For the moderate risk portfolio, I am raising the risk allocation to 45%, reducing the bond allocation to 50% and adding a 5% cash position. The narrowing of credit spreads necessitated a move in the allocation as investors are clearly willing to take on additional risk right now. This is a bit of a compromise. I normally move in 10% increments but for a variety of reasons I lay out below, I decided a full move was unwarranted. With all of my other major indicators still bearish I could not justify a 10% increase in the risk allocation.

The change to the risk budget was necessitated by the narrowing of credit spreads which has become too large to ignore. I have resisted the change until now because the longer term trend was still toward wider spreads but the big moves in the wake of the Brexit rebound made that position untenable – the trend has changed. It could very well be a short lived reversal as it appears to be entirely a function of sentiment rather than any substantive change in economic conditions. However, there is also the possibility that the narrowing of spreads will have a beneficial impact on the economy that we cannot yet observe. That is something we will only know with the benefit of hindsight. In the meantime, our process dictates a change in our risk allocation.

Indicator Review

Credit Spreads: Spreads churned around the 6% level until the Brexit vote on 6/23 when they started to widen rapidly, moving from 5.83% right before the vote to 6.57% in the two days after. But then, as with stocks, junk bonds suddenly caught a bid, Treasuries sold off a bit and spreads narrowed rapidly to the present level of 5.46%. That is the narrowest since last August although still quite a ways from the 3.35% recorded in June 2014. There has been little change in the underlying fundamentals of the junk market but we have seen a recent resurgence in new issuance. This is mostly a reflection of sentiment, of risk appetite and yield chasing.

Valuations: With the S&P 500 breaking out to new highs and earnings still declining, US valuations are at the high of the cycle. Emerging markets are still the cheapest as a group with emerging Europe cheapest of all. Developed Europe is also relatively cheap, trading at about a median valuation.

Momentum: In the US long term momentum continues to favor bonds and gold over stocks. Long term momentum for the S&P 500 is also still negative although obviously the shorter term measures have turned positive. Momentum for emerging market stocks has turned positive on a short and intermediate term basis and is on the verge of giving a long term buy signal. European stocks continue to struggle to gain momentum.

Yield curve: The yield curve has continued to flatten with the 10/2 curve now at 84 basis points, a level last seen in November of 2007. I would point out though that the curve was actually steepening back then in anticipation of Fed easing. That is typical of what happens right before the onset of recession. That we aren’t seeing that today though provides only a little comfort since short term rates are already very low.

Leave A Comment