It’s been a long time since I’ve come across a group of high-quality companies selling at truly depressed valuations. Sure, I’ve found plenty of undervalued stocks in the past few years, but the last time I was almost giddy about valuations was in 2011. Then, it was the homebuilders that became my target. Today, it is high quality natural gas E&Ps.

Video Length: 00:07:31

What makes the quality natural gas E&Ps so attractive is a combination of factors. Certainly, the historically low natural gas prices are part of the formula. The depressed stock prices are certainly a major element, as well. However, there’s also a bigger macro trend at work. There’s a strong case that demand growth for US natural gas could exceed expectations over the next decade. This combination of depressed stock pricing and significant macro tailwinds could make the quality gas E&Ps excellent buys for long-term investors.

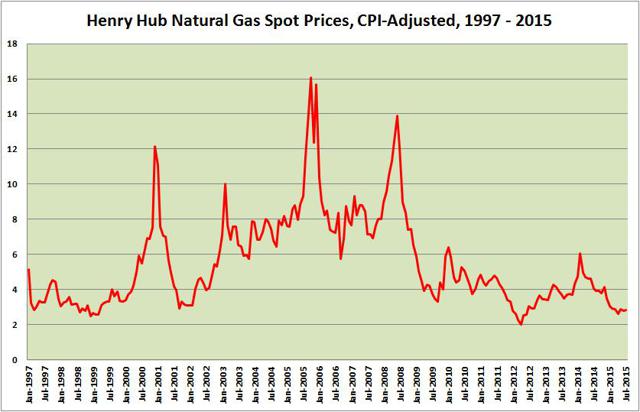

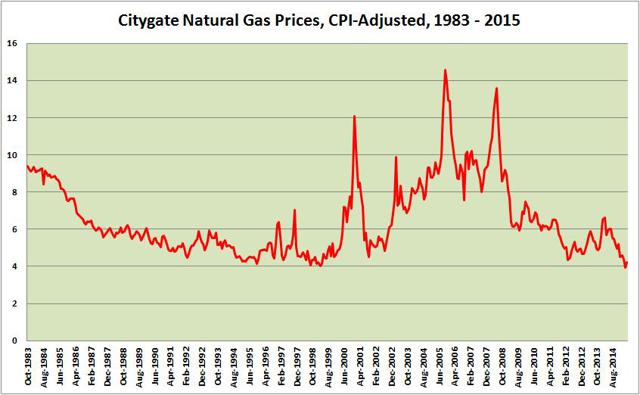

Natural Gas Prices

Natural gas prices have plunged alongside of oil in the past few months. Prices are now near historic lows based on inflation-adjusted figures. The Henry Hub spot price has fallen below $3 in 2015, while the current Citygate spot price is likely below $4.

Click on picture to enlarge

Source: Created by author

Click on picture to enlarge

Source: Created by author

On one hand, this looks bad for natural gas E&Ps. Obviously, lower prices don’t help the producers of natural gas. At the same time, this is actually quite a bullish indicator.

For starters, from a contrarian value perspective, you want to invest when the prices are low. This creates more limited downside and higher upside. With natural gas being in what is essentially a 7-year bear market and now at multi-decade inflation-adjusted lows, there’s simply less that can go wrong.

More importantly, however, is the fact that after researching several of the low cost players in the industry, it seems very unlikely to me that prices (and more importantly, spreads) can stay this low. With Henry Hub under $3 for any considerable period of time, it’s likely that we’ll see significant cuts in production, which would set the stage for a future spike in prices.

The Players

Let’s establish the players. When I speak of “high-quality” and “low-cost” natural gas E&Ps, I’m speaking of a select group of companies. The four that I am most familiar with are Antero Resources (NYSE:AR), Ultra Petroleum (NYSE:UPL), Range Resources (NYSE:RRC), and Cabot Oil & Gas (NYSE:COG).

However, you could throw in several more names. Rice Energy (NYSE:RICE) is noted as one of the lower-cost producers, but I know little about them. EOG Resources (NYSE:EOG) is also in that bucket. Then, there are several names that are more of a blend of oil and gas producing assets including Chesapeake Energy (NYSE:CHK), Devon Energy (NYSE:DVN), and Anadarko Petroleum (NYSE:APC).

While I haven’t researched every company, the attributes I seek are as follows:

(1) Low-cost producers of natural gas,

(2) Strong balance sheet or hedging strategy,

(3) Assets weighted heavily towards the natural gas side as opposed to oil

(4) Depressed valuation

While I’ve kept an eye on Chesapeake and Devon, those companies are not my top recommendations precisely because they violate attribute #3. I am, in fact, not bullish on oil long term and believe there’s a possibility that oil prices could stay depressed ($30 – $40 per barrel) or semi-depressed ($40 – $50 per barrel) for a long time. Even in a best-case scenario, it’s difficult for me to envision oil shooting up beyond $75 per barrel for any extended period of time.

I am much more interested in the natural gas side of the equation, where we’re in the middle of a 7 year bear market, but fundamentals for demand growth look reasonably strong.

Macro Tailwinds

There are two trends that could be major tailwinds for US natural gas demand. The first is natural gas exports. There’s been a considerable amount of writing done on the potential of LNG exports to European and South American markets, where natural gas prices are higher. There are many prominent investors, including Carl Icahn and Seth Klarman, buying into this idea with significant stakes in Cheniere Energy (NYSEMKT:LNG), as well. LNG exports are heavily regulated in the US and this has been a hot-button issue in the energy industry. However, with or without deregulation, LNG exports are likely to increase significantly in the coming decades.

Leave A Comment