“Here Comes $20 Oil.” That was the headline in Barron’s this weekend. The article cited the supply side (US fracking and full tilt production from Saudi Arabia and Russia) as the main driver of oil’s low price. With that in mind, Tsakos Energy Navigation (TNP) is a seaborne oil transportation and storage company that makes more money when oil prices are low and supply is high.

We believe Tsakos has inappropriately sold off because it’s a Greek company and it gets lumped in with dissimilar shipping stocks as well (we’ll show both of these statistically). Specifically, Tsakos should not have sold off as much with the Greek crisis because the Greek constitution and government exempt it from paying significant taxes on its international profits, and also because its business is unique compared to other shippers.In our view, both of these have contributed to Tsakos being undervalued in the market.

Additionally, Tsakos is increasingly profitable, its price-to-earnings is near historical lows, and its assets alone are worth nearly three times its current market valuation. We believe Tsakos common and preferred shares offer attractive dividend yields, attractive risk-to-reward profiles, and dramatic price appreciation potential.

About Tsakos: Tsakos Energy Navigation is a Greek company (Athens) that trades on the New York Stock Exchange.It is a provider of international seaborne crude oil and petroleum product transportation services.According to the company’s website, Tsakos:

“…operates a fleet of 45 modern petroleum product tankers and crude oil carriers… [the] fleet also includes one 2007-built Liquefied Natural Gas (“LNG”) carrier and two 2013-built DP2 shuttle suezmax tankers, bringing [the] total operating fleet to 48 vessels. [Tsakos has] on order an LNG carrier with expected delivery in 2016… In addition, [Tsakos has] also entered into certain agreements for additional [future] vessels.”

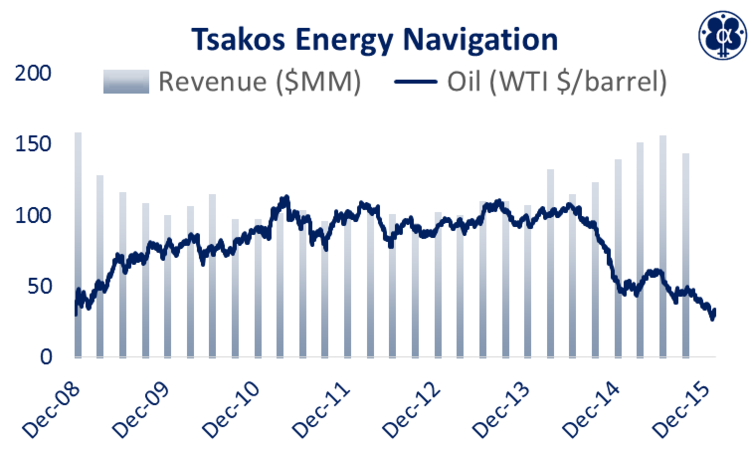

Unlike many other industries and companies, Tsakos profitability tends to increase when oil prices are low.Additionally, Tsakos benefits from the current oversupply of crude oil around the world because it increases demand for the storage capacity on their ships. According to Barron’s, the cost of chartering a crude oil carrier has recently soared as high as $80,000 per day when it was only $20,000 per day in late 2014. Also worth noting, the Greek Constitution of 1967 exempts Greek shipping companies (including Tsakos) from paying taxes on international earnings (this is an important point that we will discuss later).

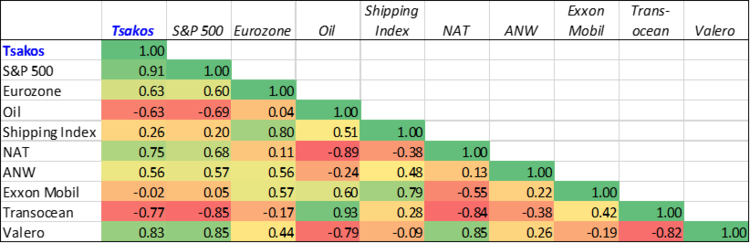

Correlations: The following table shows the correlation between the price of Tsakos common stock and a variety of other variables such as oil prices, the S&P 500, stocks of the European Monetary Union, and other shipping companies, to name a few (the data is from the beginning of 2013 through the end of last week).

The first thing to notice in the table is the strong negative correlation between the price of oil and the price of Tsakos. The negative correlation makes sense given the nature of Tsakos’ business (they make more money when oil is cheap ). Also worth noting, there is a strong positive relationship between Tsakos and the S&P 500, the Eurozone, and a global shipping index (more on these important relationships later). And for your reference, we also included a variety of other companies (not surprisingly, there is a strong positive relationship between the price of oil and Transocean (an oil driller), as well as a strong negative relationship between the price of oil and Valero (an oil refiner)).

Leave A Comment