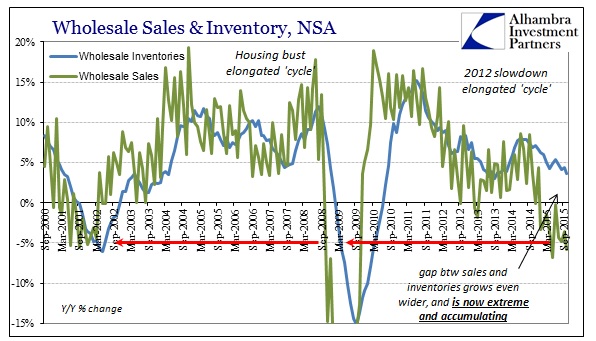

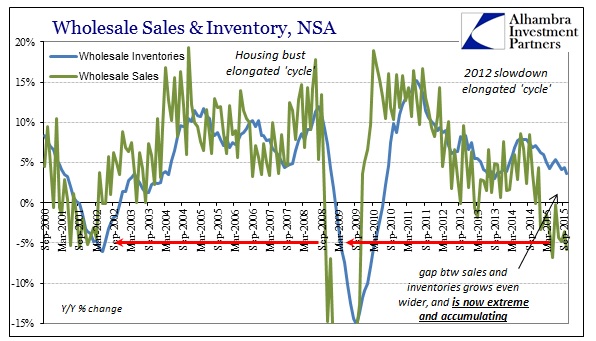

The wholesale economic problem widened again in October, even as the Commerce Dept. reported yesterday wholesale inventories rose at the slowest pace in two years. Overall, non-adjusted inventories rose by 3.6% compared to October 2014, which was less than half the rate of the summer of 2014. But that slowing inventory (which is still GDP negative in the second derivative terms) pales in comparison to the continued and outright contraction on the sales side. Total wholesale sales fell by almost 6% in October Y/Y, making for the second worst month in sales of this “cycle”, beaten only by -6.9% in May. At -5.8%, October is worse than every month of the dot-com recession and its aftermath.

It bears repeating and emphasizing that there is no clear reason for this divergence, and certainly not for it to continue as long as it has. There is no historical precedence for this outcome, leaving suspicion to reasonably fall upon Janet Yellen’s continued recovery insistence – even though the opposite is the actual and continuing condition.

As you can see plainly above, inventory and sales are almost always very closely correlated, which is just common sense. Any deviations, and sales always leads inventory, are temporary as inventories follow with some relative lag. These gaps are clustered around recessions and the recoveries that follow. When wholesale sales turned negative in February 2001, just as the dot-com recession was to begin, inventories did so seven months later toward the tail end of it. On the other side, into the recovery, sales turned positive in July 2002 while inventories followed quickly that December.

In the second part of the Great Recession, wholesale sales collapsed first in November 2008, leading inventories by just 3 months. After the recession ended, sales turned positive in November 2009 and inventories doing the same by July 2010.

In both of those cycles, the longest lag between sales and inventory was the eight months it took for sales to initiate the recovery’s restocking after the Great Recession. As it was, wholesale sales declined only for thirteen months total (though the scale of those declines was enormous). Wholesale sales turned negative last November, meaning that sales have contracted for a full year already and inventories are still growing by nearly 4%, only gently decelerating so far. That has produced a sales gap that is comparable only to the second phase of the Great Recession.

Leave A Comment