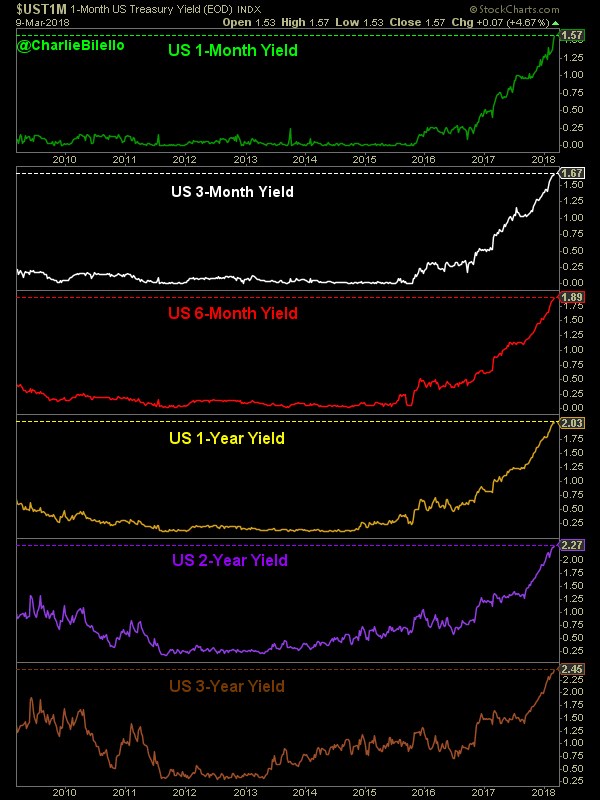

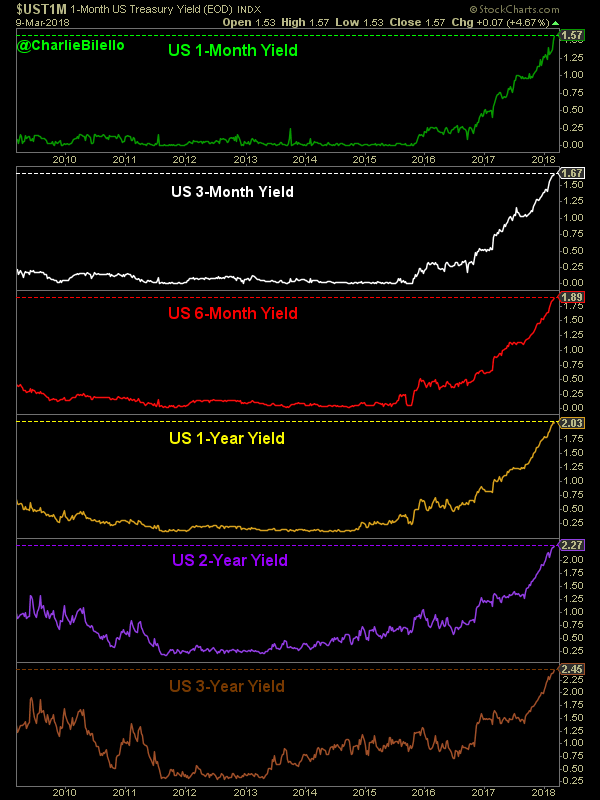

Short-term bond yields (1-month through 3-years) are hitting their highest levels in over 9 years.

Why?

The market (Fed Funds Futures) is expecting the Federal Reserve to hike rates 3 more times in 2018:

This would bring the year-end Fed Funds Rate to a range of 2.00 – 2.25%, its highest level since September 2008.

So is cash no longer trash?

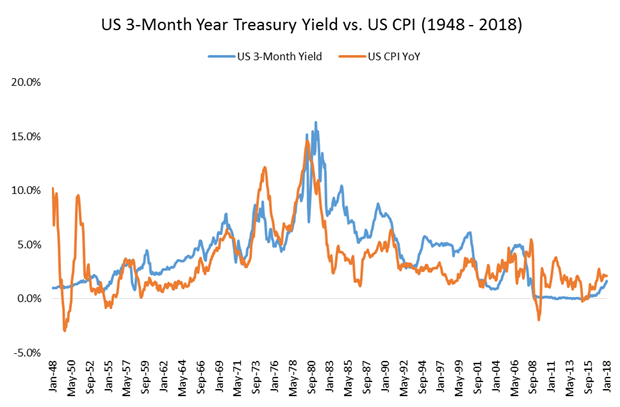

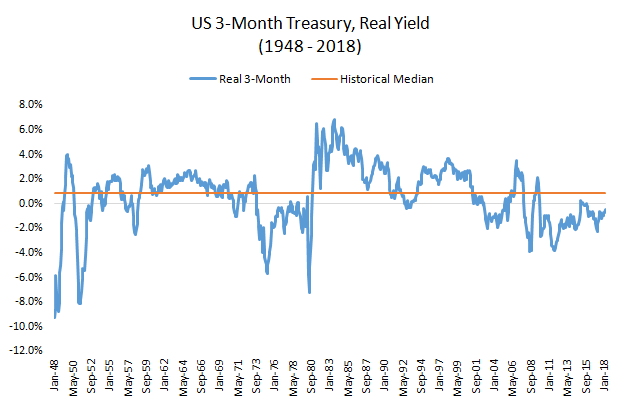

That depends on your definition of “trash.” If by “trash” you mean a nominal rate close to 0%, then yes, it is certainly not trash anymore. But if by “trash” you mean an interest rate below inflation (negative real yield), it would still hold that moniker.

A positive real yield (yield above inflation rate) is something cash-like instruments have lacked during much of the past 9 years as the Federal Reserve has maintained easy monetary policy far longer than any prior period in history. The Fed held short-term interest rates at close to 0% for 7 years (December 2008 to December 2015) while inflation was still positive (averaging 1.7% per year), meaning cash holdings failed to keep pace with rising prices. During this period, “trash” was a fair depiction, as the loss of purchasing power was over 12%.

Data Source: BLS, Stern.NYU.edu/~adamodar, FRED

In December 2015, the Fed finally raised rates off of 0%, but thus far it has been the slowest hiking cycle in history with only 5 quarter-point hikes in the past two years (current range of 1.25-1.50%). Inflation averaged 2.1% in both 2016 and 2017, meaning “trash” was still a pretty accurate depiction.

But with the Fed expected to hike this month (to 1.50-1.75%) and again in June (to 1.75-2.00%), cash is becoming less trash-like by the day. If inflation holds steady (currently at 2.1%), we could see positive real yields by year-end.

Data Source: BLS, Stern.NYU.edu/~adamodar, FRED

Leave A Comment