The narrative about the Q1 earnings season is one of all-around strength. But you wouldn’t see evidence of this strength in the stock market’s recent performance. The major indexes haven’t done much since the start of the year and performance since this earnings season got underway has hardly budged.

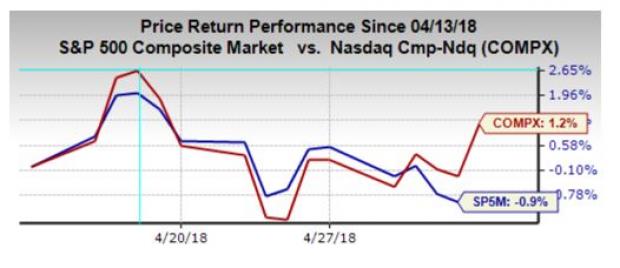

The chart below shows the performance of the S&P 500 index and the Nasdaq Composite since the April 13th earnings release from JPMorgan (JPM).

We need to lean on uncertainty about trade, the evolving inflation picture and geopolitics to explain a big part of the lack of follow through in the market, but we can cite some chinks in the earnings armor as well.

We should keep in mind that while earnings have been very strong, a lot of that strength was already expected and didn’t surprise many in the market. The fact is that the earnings picture had been steadily improving since the second half of 2017 and in some respects the 2017 Q4 earnings season was actually a lot stronger than what we are seeing companies report this earnings season.

There has not been any incremental improvement in the earnings outlook relative to what was expected ahead of the start of this earnings season. We see this in the underwhelming revisions trend for the 2018 Q2 quarter, which is in contrast to the very positive revisions trend we saw ahead of the start of the Q4 earnings season.

You can see this in the almost no change to aggregate 2018 Q2 estimates as the chart below shows:

A big part of the positive revisions we saw ahead of the start of the Q1 earnings season reflected the direct impact of the tax law changes, which was obviously a one-off development. Had all positive revisions been a result of tax law changes, we would have seen only EPS estimates go up, with no changes to revenue estimates. But that wasn’t the case, as revenue estimates had gone up as well, which raised our hopes that the aggregate revisions trend had finally turned positive after many years being in the other direction.

Leave A Comment