THE CROSSING

As opposed to the week prior, the market action during the first half of this past week was much more positive. What was interesting, was despite the absolute drubbing that investors have taken since the beginning of the year, the three-day advance saw a surge of “bulls” running into the fray “claiming victory” over the bears. This is hardly the case.

In last week’s missives, I discussed the potential for an oversold, short-covering bounce which was to be used to further rebalance portfolios and reduce equity risk. The target zone was 1940 to allow for the completion of the “risk reduction” process.

“On a very short-term basis the market is oversold and the bounce on Friday was JUST enough to close above the October lows support at 1860. Any continued rally next week should be used to further reduce equity risk and rebalance portfolios.”

“However, market bulls will argue, and correctly so, that the continued retests of the 1860 level by the markets is building bullish support for the market. However, this action is not uncommon at major market peaks as it takes time to erode bullish “hopes” to the point those supports finally give way.

With the markets once again oversold after last week’s fairly brutal sell-off, a rally is expected over the next couple of days to allow portfolio risk to be rebalanced. That rally could take the markets back to the previous resistance of 1940 (about a 4% push) from current levels. Such a rally would be enough to suck many of the“bulls” back into the markets pushing markets back into overbought territory and setting up the next decline.”

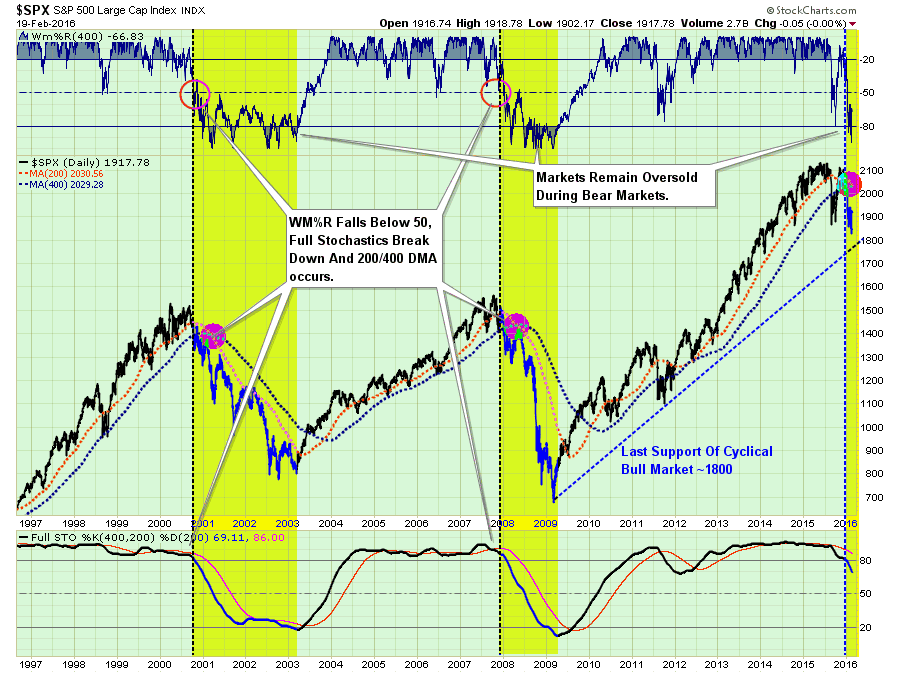

I have updated the chart above, below. As discussed last week, the “bulls” did come stampeding back into the market as expected which pushed the markets back into extreme overbought territory.

Importantly, note that in the last week the spread between the 200 and 400-dma collapsed this past week from a near 5-point spread to just a little more than 1-point at Friday’s close. This signal will cross next week. Whether or not the “crossing” is the signal of a new cyclical bear market is yet to be seen, but historically it has almost always been the case.

TOO MANY BEARS?

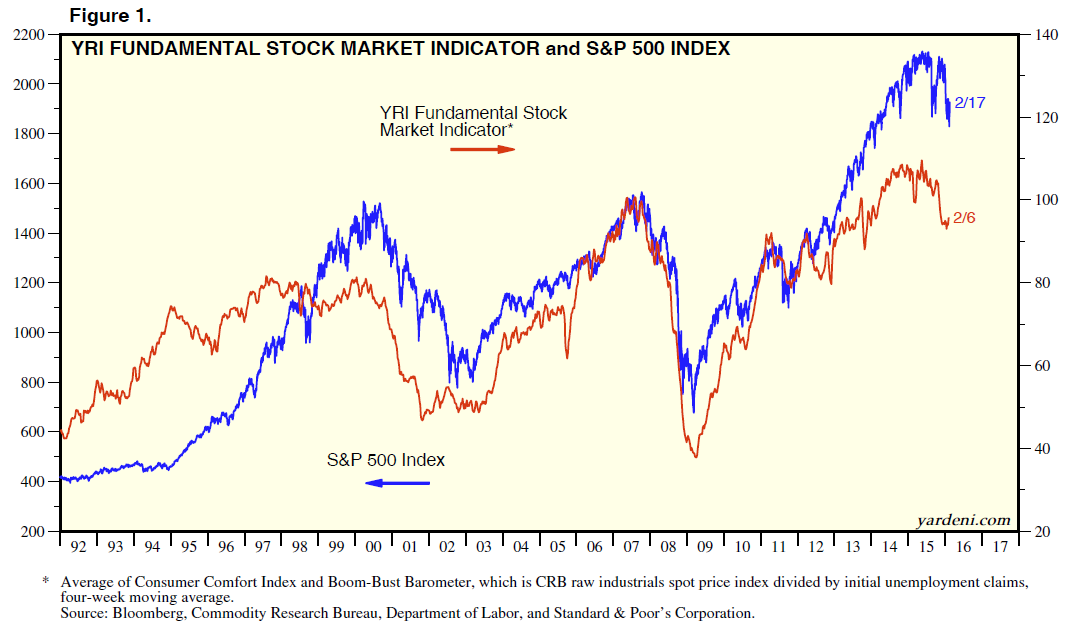

While there are many indicators suggesting more extreme levels of bearishness, which are often the catalysts for at least a short-term push higher in the markets, this has not always been the case. As shown in the chart below, courtesy of Ed Yardeni Research, the bull/bear ratio is now under 1.0 which suggest rather extreme levels of bearishness. Time for the bear market to be over, right? Not so fast.

As you will notice, while in many cases excess bearishness led to rallies during cyclically trending bull markets, during more “bearish” markets, bearishness tended to remain bearish and rallies led to deeper corrections.

However, while bearish sentiment generally provides fuel for shorter term rallies, it is ultimately the underlying fundamentals that provide the sustainability to market direction. As Yardeni also point out, markets tend to follow fundamental underpinnings very closely. If the current downturn in fundamentals continues to build momentum, the markets could be very early in their corrective process.

As I have noted before, bearishness tends to remain a constant companion during cyclical bear markets. As investors are repeatedly molested by ripping bull rallies, and plunging declines, such action keeps markets in oversold territory until the “beatings have improved overall morale.”

Yes, this time “could be different.”

The Fed could use negative rates, launch another round of QE, or even a combination of the two which would once again push markets higher. However, until such a “Unicorn” appears, we must live in the land of reality and deal with“what is.”

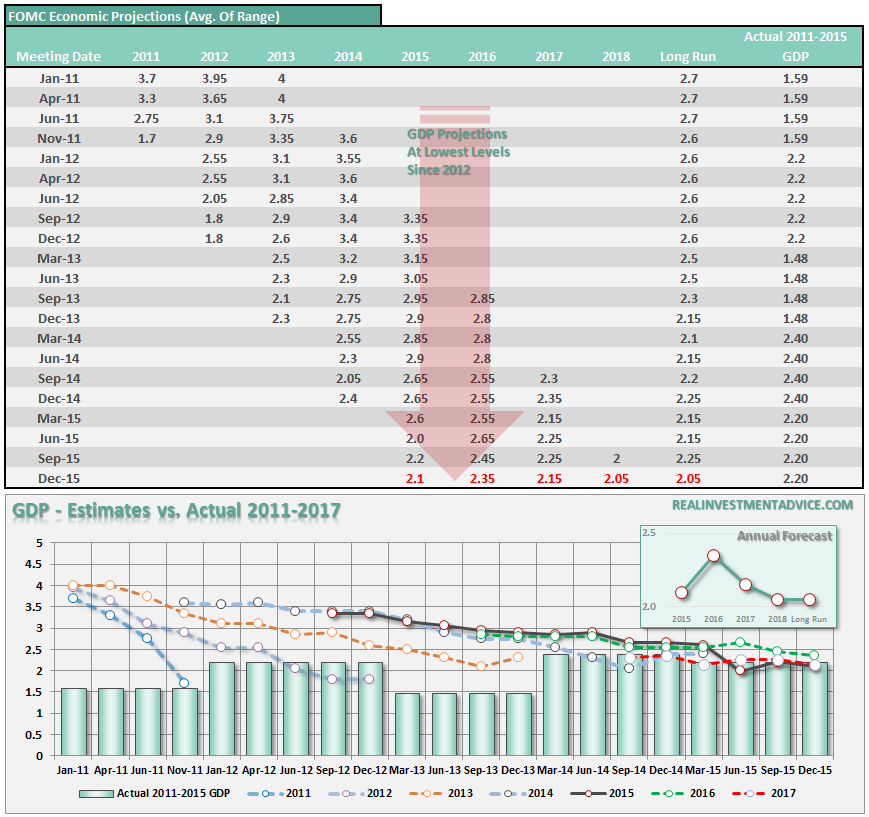

OECD – IT ISN’T MENTAL THING

Beginning in 2011, I began tracking the Federal Reserve’s quarterly economic assessments released after each of the policy-making meetings. Besides the fact they are the absolute worst economic forecasters ever, it was provided to give a sense of transparency into the Fed’s actions.

However, following the January policy meeting, there was a very material issue, “no economic outlook.”From the NYT:

Leave A Comment