Whenever the topic of recession comes up, the mainstream and especially economists (redundant) become quite defensive about the possibility. Just a few days ago, presidential candidate Donald Trump claimed the US was headed for “a very massive recession” and that it was “a terrible time right now.” The Washington Post, as you would expect, was skeptical of the claim because orthodox economics will have none of it, writing that Trump is “embracing a distinctly gloomy view of the economy that counters mainstream economic forecasts.”

While the Post was serious in its counter, they should not be so confident given past history of mainstream forecasts, economic as well as anything else. As retired Dallas Fed President Richard Fisher correctly pointed out (at least in all likelihood), the staff at the Fed was put to shame by his dry cleaner. Still, part of the problem is lost context in that nobody actually seems to remember what recovery and growth is truly like. We see story after story claim that the economy is strong or consumers resilient when whatever economic account bears no resemblance at all to past occurrences of “strong” or “resilient.”

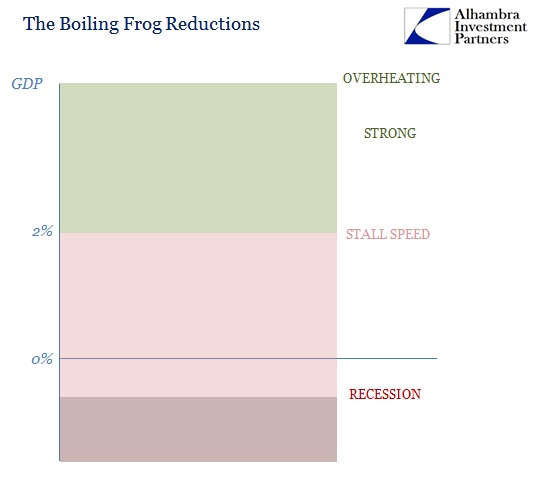

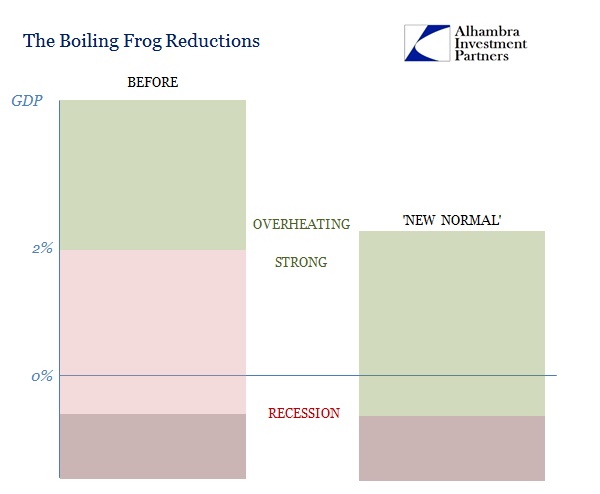

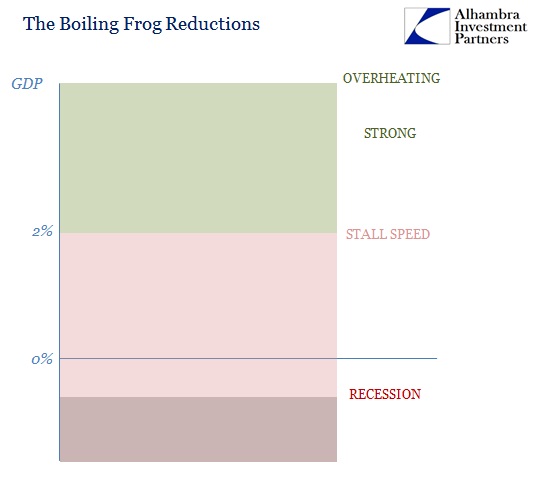

The issue of recession, however, is only somewhat separate. Because of this reduction in standards, the mainstream accepts only a binary proposition anymore – the economy is either growing or it is in recession. Further, any economic circumstance that doesn’t fit the traditional pattern of recession is then used to confirm the interpretation that there cannot be recession.

It used to be convention that 2% GDP growth represented an intermediate danger zone akin to “stall speed” in aeronautics. Now, as we traverse past and even out of the “new normal”, 2% GDP is somehow used to justify “overheating.” Because labor market statistics are so robust, the balancing act to GDP must be the same even if the very definition of “overheating” has to be reduced to what at one time was universally accepted as dangerous.

After more than a year of negative numbers especially in manufacturing and industry, because there is no “V” to it that is believed confirmation that it is just some marginal weakness to be dismissed via a resilient baseline or trend that will reassert itself given enough time. This discontinuity to the normal, historical business cycle pattern is being used as evidence for the economy remaining in growth mode when it should be instead forcing re-evaluation of what we know of the whole contraction process.

“Politicians and market experts keep saying the economy is trouble, but the data keep telling us that is just not the case,” Joel Naroff of Naroff Economic Advisors said.

“Those who downplay the economy’s strength should really just quit the exaggeration, trying to scare the already angry electorate into putting themselves into office,” Rupkey said. “Just quit it.”

“The economy is stronger than you think.”

Leave A Comment