A year ago, the Bank of Canada (BOC) delivered the first of two rate cut surprises for the year. So with oil still cratering ever lower, I can understand why the market seemed braced for yet another rate cut last week. Instead, the BOC not only stood still on rates, but also it expressed an implied reluctance to reduce rates any further unless absolutely necessary. The result was an immediate jump in the Canadian dollar (FXC) featuring a drop in USD/CAD. USD/CAD continued to sell off right into the week’s close.

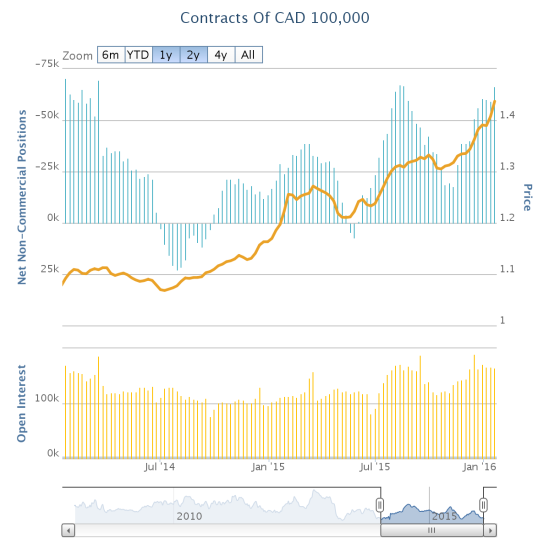

Going into the Bank of Canada January, 2016 decision on monetary policy, speculators were ramping up net short positions against the Canadian dollar.

Source: Oanda’s CFTC’s Commitments of Traders

USD/CAD printed topping action just ahead of the Bank of Canada decision. The currency pair has shot nearly straight down ever since.

Source: FreeStockCharts.com

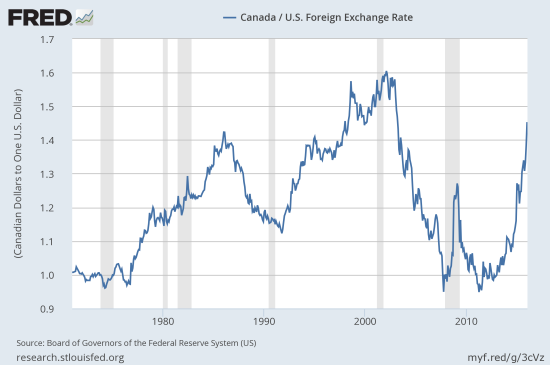

The Canadian dollar has been weaker but the PACE and extent of the weakening is nearly without recent precedent.

Source: Board of Governors of the Federal Reserve System (US), Canada / U.S. Foreign Exchange Rate [DEXCAUS], retrieved from FRED, Federal Reserve Bank of St. Louis, January 23, 2016.

Here is the key quote from Governor Stephen S. Poloz’s opening statement:

“It is fair to say, therefore, that our deliberations began with a bias toward further monetary easing.”

The on-going collapse in oil and all its destructive consequences for the Canadian economy still justify further easing. BUT…

“First, the Canadian dollar has declined significantly since October, which means that the non-resource sectors of our economy are receiving considerably more stimulus than we projected then. Let’s remember that it typically takes up to two years for the full effect of a lower dollar to be felt.

Second, past exchange rate depreciation is already adding around 1 percentage point to our inflation rate. This is a temporary effect, and is currently being offset by lower fuel prices—another temporary effect. However, we must be mindful of the risk that a further rapid depreciation could push overall inflation higher relatively quickly. Even if this is temporary, it might influence inflation expectations.”

Leave A Comment