It always amazes me how most analysis on an investment focuses on recent performance, rather than process. Yet, so little attention is given to the investor return/behavior gap, a well-documented phenomenon that proves that “on, average, investors sacrifice a substantial portion of their returns by incorrectly timing when to enter or exit investments.”

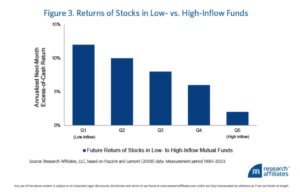

Incorrect timing tends to come from chasing performance, getting in after a major up move has already taken place, and then, of course, exiting when the drawdown is likely near its end.The below chart sums up some of the research on this which remarkably few are aware of when considering where to put money to work.

The best returns in the future come from those parts of the marketplace that have not done well in the past.Yet despite the overwhelming evidence which supports this, strong recent performance is often the core catalyst to make an investment.In reality, it should be the exact opposite.

High past performance and continuous visibility of that performance is a temptation too strong for many to ignore, and that temptation unequivocally results in sub-optimal returns going forward on average.Take that truism on mutual funds, and magnify it by a billion when it comes to Exchange Traded Funds (ETFs). Yes folks – I would argue to you that ETFs are the greatest danger to investors.Why? Because ETFs provide an even greater temptation to chase recent performance, day by day, hour by hour, and minute by minute. Overtrading is the ultimate source of the investor return gap, and the temptation to get “in and out” of the market has never been higher thanks to these investment vehicles.

Now, don’t get me wrong here.We ourselves use ETFs to execute across our quantitative strategies in mutual funds and sub-advised separate account strategies we run. However, following a systematic, backtested, and quantitative approach using ETFs as the vehicle of choice for execution is NOT what the vast majority of ETFs “investors” do. The pattern of behavior remains the same. Assets for ETFs grow when the ETF has strong recent performance, and collapse after, with a lag, when losses have already occurred. In our case, we rotate based on leading indicators of volatility (click here to learn more).The majority rotate based on old leaders that have had continuously low volatility.

Leave A Comment