Revolving consumer credit turned upward in March last year, which signaled to economists that the true end of the Great Recession was at hand. The largest impediment to the monetary version of the recovery was the “debt hangover” from the mortgage surge during the housing mania. Consumers, rightfully cautious after that disastrous experience, spent the early years of the “recovery” eschewing debt beyond student and auto loans. Both mortgage growth and credit card growth (revolving) was historically weak.

The shift in revolving credit, then, seemed to suggest what Janet Yellen had been saying about the economic prospects in relation to the “best jobs market in decades.” From this view, jobs were turning to incomes which were turning to freer spending patterns and thus leading at least more closely toward “overheating.” It seemed like real confidence in borrowed dollars.

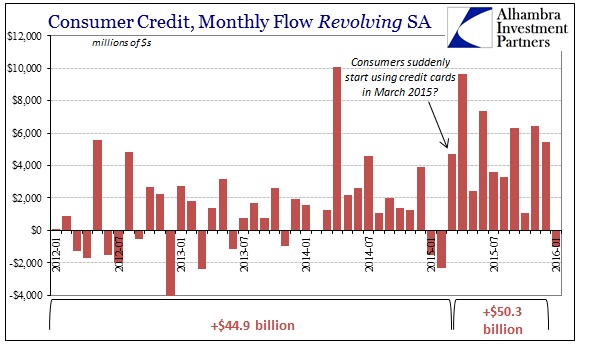

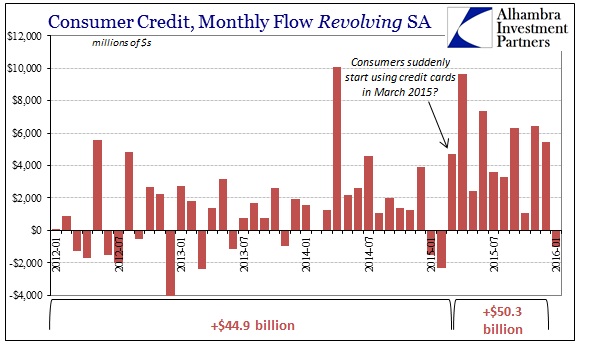

After only a few months it was clear that this had indeed been an inflection. The numbers over the past year leave no doubt; revolving consumer credit grew by just $44.9 billion from January 2012 through February 2015 but by $50.3 billion in just the 10 months March 2015 through December. With revolving credit falling again in January 2016, there is some immediacy to getting the prior interpretation right. During the worst of last year’s “financial turmoil”, the Wall Street Journal for one was firmly of the view that consumer credit was a hugely positive sign for not just skating out of that mess but for the full recovery/Yellen scenario:

Americans quickened their pace of borrowing in September, a sign of confidence in the economy amid low gas prices and a strong dollar.

Outstanding consumer credit, a reflection of nonmortgage debt, rose $28.9 billion, or at a 10% annual rate, in September, the Federal Reserve said Friday, the largest percentage increase since April 2014…

Revolving credit, mostly credit cards, rose at a 8.7% annual rate. In August, it rose at an annual rate of 5.3%.

Leave A Comment