Almost a month ago, I celebrated a major breakout for iPath Bloomberg Cocoa SubTR ETN (NIB) by declaring a confirmed bottom. That bottom still holds but unfortunately NIB has persistently declined since then. NIB is down 15.2% from the time of that post.

The iPath Bloomberg Cocoa SubTR ETN (NIB) erased two months of gains in one month. A major breakout turned into another big breakdown with the previous all-time low looking like a pivot again. Source: FreeStockCharts.com

At the time of my last post, the International Cocoa Organization (ICCO) seemed cautiously optimistic about the prospect for prices. Demand also seemed to be responding to low prices. From there, a story for cocoa evolved that includes a healthy mix of conflicting supply/demand narratives. In this post, I briefly review the various catalysts and justify my strategy to re-accumulate a short-term trading position to augment my core NIB position. NIB continues to trade with more volatility than the underlying fundamentals, so I am betting on periodic relief rallies when selling panics subside.

Bullish Olam, Bearish Barry Callebaut

As NIB traded down toward support at its 50-day moving average (DMA), Olam (OLMIF), the world’s 3rd largest cocoa processor, issued a bullish outlook for cocoa that echoed my own expectations. In “Global Chocolate Binge Has Olam Predicting Smaller Cocoa Surplus,” Bloomberg wrote on November 24th about drivers supporting prices in the cocoa market using commentary from Olam as the centerpiece.

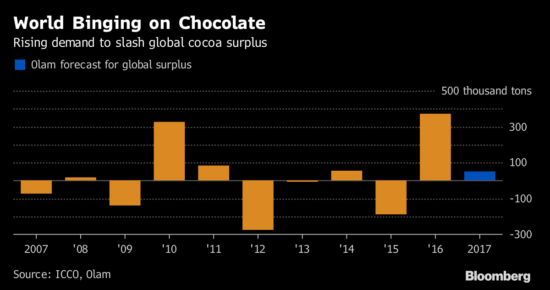

Olam called the demand for chocolate “tremendous.” The company also doubted that Ivory Coast could deliver the same kind of bumper crop as it did the previous season. As a result, the company projected a sharply lower surplus for the 2017/18 season.

The 2016 cocoa surplus sticks out as a tremendous outlier if Olam’s forecast of a small surplus pans out. Source: Global Chocolate Binge Has Olam Predicting Smaller Cocoa Surplus

Olam went on to explain how traders may be underestimating the demand for chocolate because “traditional data” do not include sales from online businesses, artisan shops, and bakeries. Moreover, the current surplus cocoa includes low quality cocoa damaged by a reduction in fat content and an increase in free-fatty-acid levels.

Leave A Comment