While interest rates are slowly rising, they remain at historically low levels. As a result, many income-focused investors continue to search for the best high dividend stocks to meet their long-term investing needs.

High dividend stocks can be an appealing way to fund a portion of retirement through dividends rather than the selling of shares, but high-yields can sometimes be a warning that a company’s business model is broken and best avoided.

In other words, some beaten-down, high-yield stocks are value traps with poor dividend security, making them unacceptable for a retirement portfolio.

Let’s take a look at Tupperware (TUP), whose 4.6% dividend yield and track record of paying uninterrupted dividends for more than 20 consecutive years may at first make it seem like an appealing choice for high-yield investors (it’s a famous household brand after all), to see if this company’s dividend is suitable for low-risk income investors.

Business Overview

Tupperware Corporation was founded by Earl Tupper in 1946 in Orlando, Florida, and incorporated in 1996. In 2005, after a series of large-scale acquisitions of different product segments, the company changed its name to Tupperware Brands.

Today, Tupperware is a global direct-to-consumer marketer of numerous household goods, including containers, cookware, knives, microwave products, microfiber textiles, water-filtration related items, and an array of on-the-go consumer products.

The company’s business model is heavily reliant on social marketing, also called multi-level marketing, in which customers become Tupperware consultants (3.2 million at the end of Q3 2017) who market to friends and family via its famous group demonstrations (such as the famous “Tupperware parties”).

Source: Tupperware

The company has also diversified into skin and hair care products, cosmetics, bath and body care, toiletries, fragrances, jewelry, and nutritional products via its acquisitions of numerous brands: Avroy Shlain, NaturCare, Nutrimetics, Fuller, BeautiControl, Armand Dupree, Fuller Cosmetics, Del Baul de la Abuela, Natural Forte, Fuller Royal Jelly, Nutri-Rich, NC Express, and Nuvo.

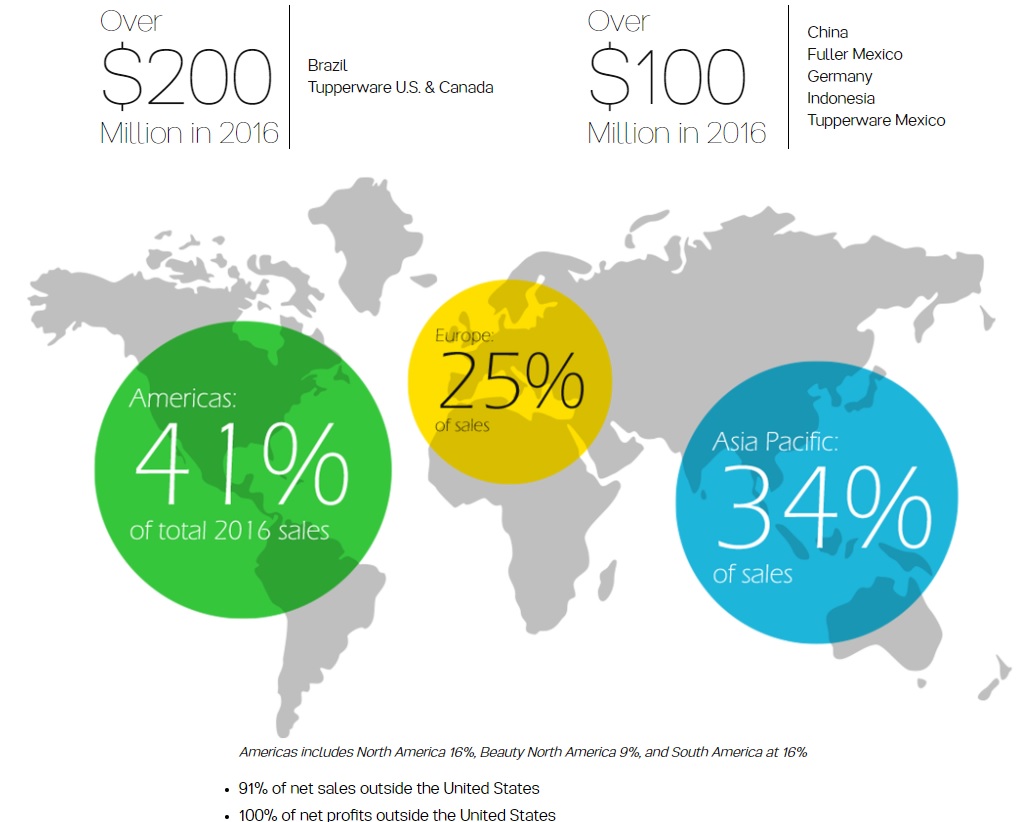

Tupperware is a geographically diverse company. For example, in 2016 approximately 91% and 100% of Tupperware’s sales and net profits, respectively, were from outside the U.S., with 66% of sales coming from fast-growing emerging markets such as Mexico, Brazil, India, and China.

Source: Annual Report

Business Analysis

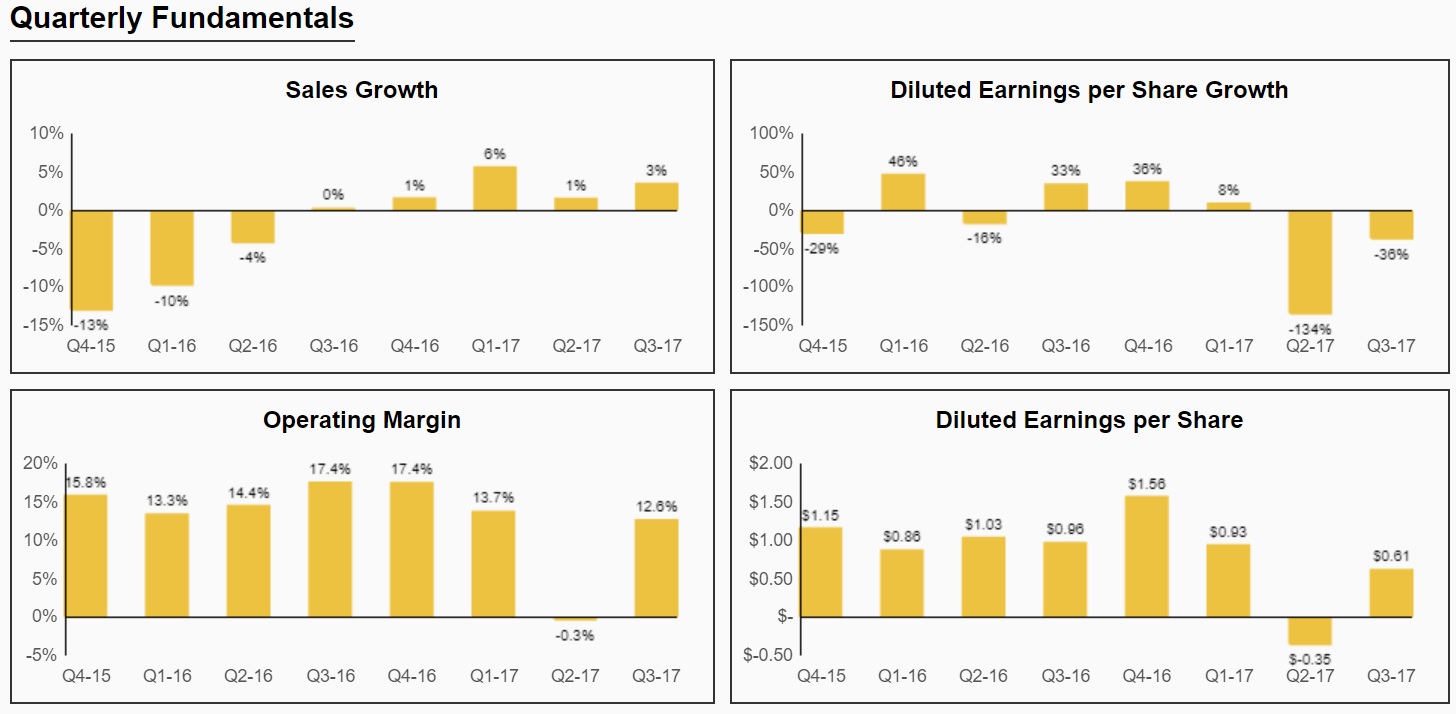

It’s been a rough few years for Tupperware, with the company facing declining sales, earnings, and cash flow since 2013.

Source: Simply Safe Dividends

The company announced a major restructuring in July 2017, shutting down its North American Beauticontrol business, which has been suffering from declining sales and profitability.

This will mean that going forward, even less of the company’s sales will come from North America, and management expects to see cash costs of $90 to $100 million associated with the restructuring through the end of 2019 ($25 million in 2017).

The restructuring is also designed to consolidate the supply chain, in order to decrease annual marketing expenses by $35 million per year.

However, this restructuring means that, while growing overseas sales have halted the top line decline, earnings and free cash flow are likely to remain depressed over the next few years.

Source: Tupperware earnings presentation

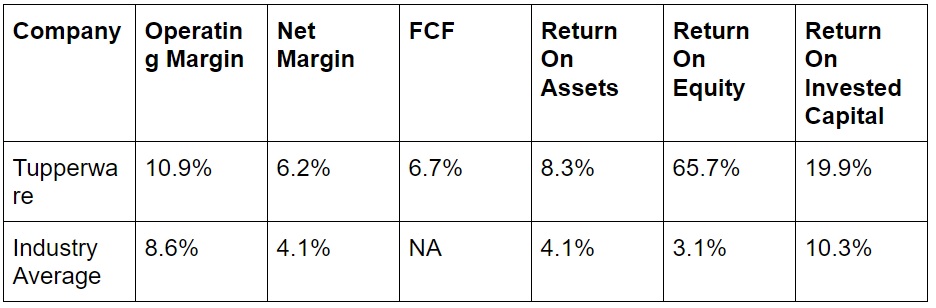

This will likely mean a decline in the company’s margins and returns on capital, which on the plus side have historically been above the industry average (Tupperware sells premium, high margin products).

Sources: Morningstar, Gurufocus, CSImarketing

The big concern for dividend investors is that declining free cash flow, which is what funds the dividend, could put the current generous payout at risk, especially given the company’s plans to aggressively de-leverage its balance sheet (pay down debt).

Now the good news is that management has a multi-pronged long-term international growth strategy it calls “Vision 2020”.

The strategy calls for more aggressive international expansion (sales force is up 4% this year), but also:

Source: Tupperware investor presentation

In addition, the company plans to launch over 100 new products in the coming years, which it can use to more fully stock its upcoming brick and mortar stores.

However, there are numerous problems with Tupperware’s long-term strategy, including a potentially fatal flaw in its core business model.

Key Risks

First, because 91% of sales (and 100% of profits) come from outside the U.S., Tupperware has large foreign currency exposure.

This means that when the US dollar rises against other currencies (such as when U.S. interest rates rise relative to rates in other countries, as is happening now), local sales end up translating into fewer dollars, and thus create profit and dividend growth headwinds.

A stronger dollar also makes Tupperware’s products more expensive (and less competitive) overseas, which is literally where more than 100% of growth is expected to come from in the future.

That’s because mature markets, such as the U.S., Canada, Europe, and Australia are seeing declining sales and earnings over time, even in newer and more trendy business segments such as cosmetics and health supplements (which is why Beauticontrol was shut down).

But what about fast-growing emerging markets? These have much larger populations, rapidly expanding economies, and booming middles classes. Could not these, when combined with 100 new products in development and a more hands-on (traditional retail) focus help Tupperware grow strongly as it has in the past?

While this is certainly possible, there are two main risks to the company’s turnaround plan.

Leave A Comment