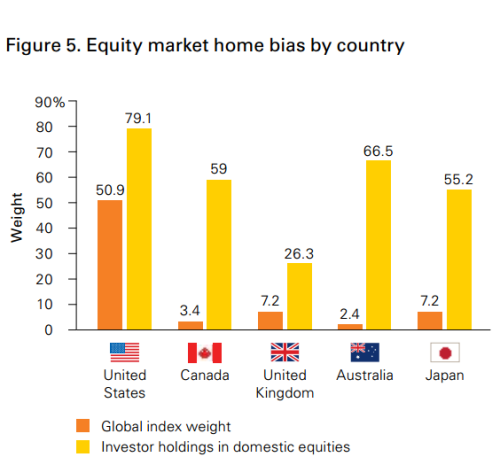

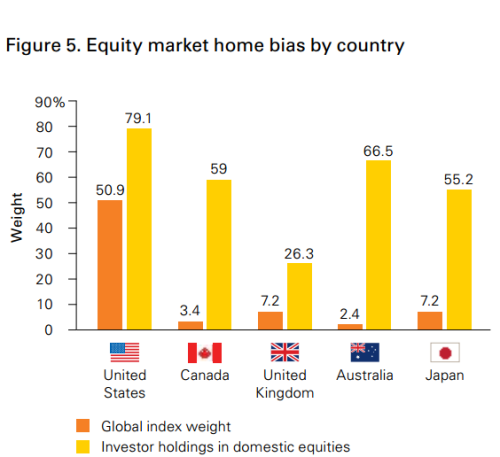

Home bias (favoring your home country in making asset allocation decisions) is pervasive. This is true in spite of the mountain of evidence that suggests it’s sub-optimal: international diversification has been shown to reduce risk in a portfolio over the long run without hurting return.

Why do investors make “sub-optimal” decisions? Because they are human beings, not machines. Favoring one’s home country in making asset allocation decisions feels good, and feelings are the most important driver of investor decisions. We are also told by many to “invest in what you know,” and what we know best are assets in our home country.

If you are a U.S. investor and have more than 53.5% of your equity allocation in U.S. stocks (the latest weighting in Vanguard’s Total World Stock Index), you are practicing some form of home bias. You are also, as I wrote last year, not a purely passive investor – you are making an active decision to deviate from the global market portfolio. That may or may not be a good decision, but it is an active decision nonetheless.

Most investors, regardless of their country and whether they know it or not, are practicing home bias in one form or another (if not in stocks then in bonds/REITs/etc.). Perhaps the most extreme example is Australians, who have a 66.5% weighting to their home country stocks while Australian equities make up only 2% of the global equity market.

Source: Vanguard

While academic studies focus on the long, long run (showing the benefits of international diversification), most investors live in the world of the short run, which is their own personal experience. In such a world, there will be many times where engaging in home bias actually helps you, as the home country outperforms. This serves to reinforce the idea that excluding international assets is the right decision.

U.S. investors today are living in such a time.

Leave A Comment