The stock market was up modestly on Thursday after the big news surrounding the Comey testimony and the ECB statement were released. It’s now focusing on the U.K. elections which will affect Friday’s trading. The market has been so quiet, small moves that these events cause look like big moves because volatility has vanished this year. In terms of the stock market’s intermediate term moves, this political news is mostly hot air. I’m not saying it doesn’t matter to you, but it doesn’t matter to stocks which should trade based on their future cash flows.

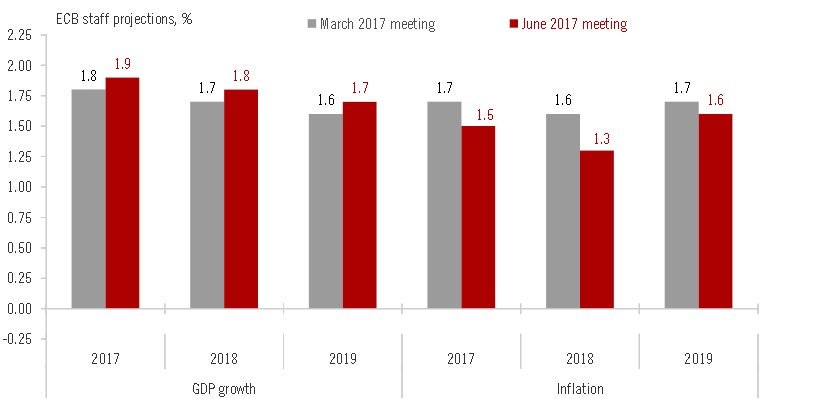

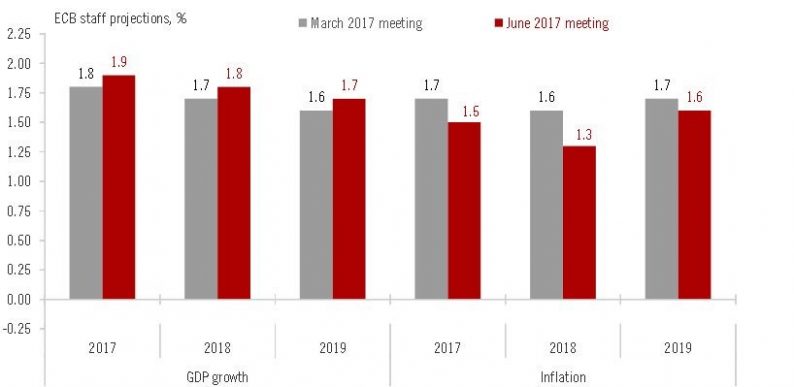

As I predicted, the ECB didn’t cause much movement in the stock market, but it was very important. There were surprises in the statement. I can see the logic behind them, but they weren’t my base case expectations. The chart below shows the changes in the ECB’s forecast for GDP growth and inflation. The changes in GDP growth are not surprising. The initial expectation for 1.8% seemed high at the time it was made, but now it seems low. I think these GDP expectations are like a dog trying to chase its tail. Expectations only increased because Q1 was great. If the forecasters didn’t predict Q1 was going to be as good as it was, how will they predict how good the rest of the year will be? These predictions are meaningless in terms of accuracy, but we must watch them because they effect central bank policy.

The HICP inflation expectation changes were the surprising part of the June meeting. As you can see, the 2017 expectations were lowered by two tenths, the 2018 expectations were lowered by three tenths, and the 2019 expectations were lowered by one tenth. The base case expectation was lowing them each by one tenth. The 1.3% inflation expectation for 2018 is the lowest expectation in the history of the metric.

Analysts are saying that the inflation expectation for 1.5% ruins the ECB’s credibility because inflation was at 1.5% before QE was started. I disagree with this assertion. There are two types of credibility. The first is whether the ECB will act on what it says it will do. ECB president, Draghi’s “whatever it takes” statement has been backed up by an enormous amount of QE. The ECB’s balance sheet is larger than the Fed and the JCB’s balance sheet.

Leave A Comment