Looking at tomorrow’s main event, the much anticipated ECB announcement in which Draghi may (or may not) announce a hawkish shift to the centrral bank’s policies and/or reveal the bank’s tapering plans, Citi (whose titled we borrowed) gives the 30 second summary, and says that the market seems quite split on whether the ECB will remove the asset purchase program easing bias, but thinks that there’s room for mild disappointment. After all, it says, this meeting is just a warm up for the September meeting (and Jackson Hole). CitiFX Strategist Josh O’Byrne points out that the biggest market fear at the moment appears to be long positioning and “this risks morphing into FOMO for the next leg higher.” For the press conference, Citi expects Draghi to slightly tweak some of the language from Sintra to lean a little bit more towards the dovish side.

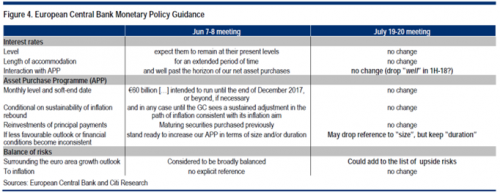

The bank’s expectations are summarized in the following handy cheat sheet:

From UBS, here is a big picture menu of ECB policy choices for normalization:

Another snap preview comes courtesy of SocGen which says that questions on possible exit scenarios should dominate the press conference.

While acknowledging the strength of the economy, Draghi is likely to counter any ideas of an imminent and rapid path towards ending QE, instead urging patience with the still-subdued inflation outlook. We maintain our call for an announcement in September of a six-month extension of the APP into 2018 at €40bn/month, followed by data-dependent quarterly reductions. Meanwhile, we expect the euro area consumer confidence indicator to stabilise as historically high levels (SGe 1.3%) in July. Elsewhere, in the UK, we look for only a modest bounce in retail sales in June.

* * *

With the intros out of the way, Below is an extensive preview of what to expect, courtesy of RanSquawk

ECB Preview: Rate Decision due at 1245BST/0645CDT and Press Conference at 1330BST/0730CDT

RATE/ASSET PURCHASE EXPECTATIONS

CURRENT ECB FORWARD GUIDANCE

Leave A Comment