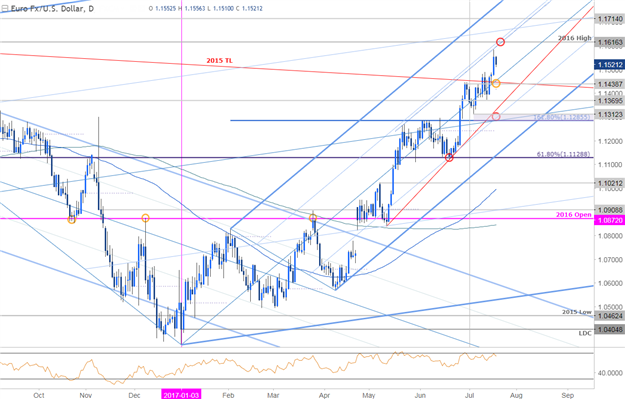

EUR/USD Daily Timeframe

Technical Outlook: Euro tested up-slope resistance yesterday after breaking above a multi-year trendline extending off the August 2015 high. Heading into the European Central Bank (ECB) interest rate decision tomorrow, the immediate focus range is 1.1439-1.1616. The immediate advance as at risk while within this range with the broader outlook weighted to the topside while above 1.1285.

EUR/USD 240min Timeframe

Notes: A closer look at price action sees the pair reversing off up-slope resistance this week with the 2016 high converging on the 75% line just higher at 1.1616. Interim support rests at 1.1495 with the immediate focus higher while above 1.1439– A break below this region would risk a larger correction targeting 1.1366& broader bullish invalidation at 1.1285-1.1312.

A breach of the highs keeps the broader long-bias in play targeting subsequent topside objectives at 1.1714& the upper parallel (currently ~1.1770s). As always, these interest rate decisions invite a great deal of volatility and the focus will be on the accompanying commentary from President Mario Draghi.

From a trading standpoint, I would be looking to fade weakness on a spike lower tomorrow into the lower parallels – If euro is heading higher, price should hold above the weekly range lows. At the same time, failure at the upper parallel again would suggest near-term exhaustion in price- stay nimble into the release.

Leave A Comment