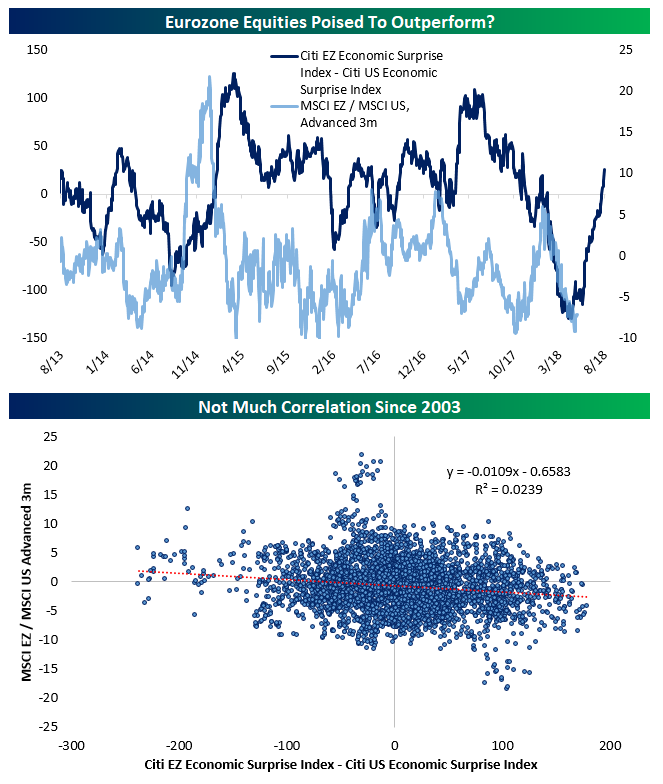

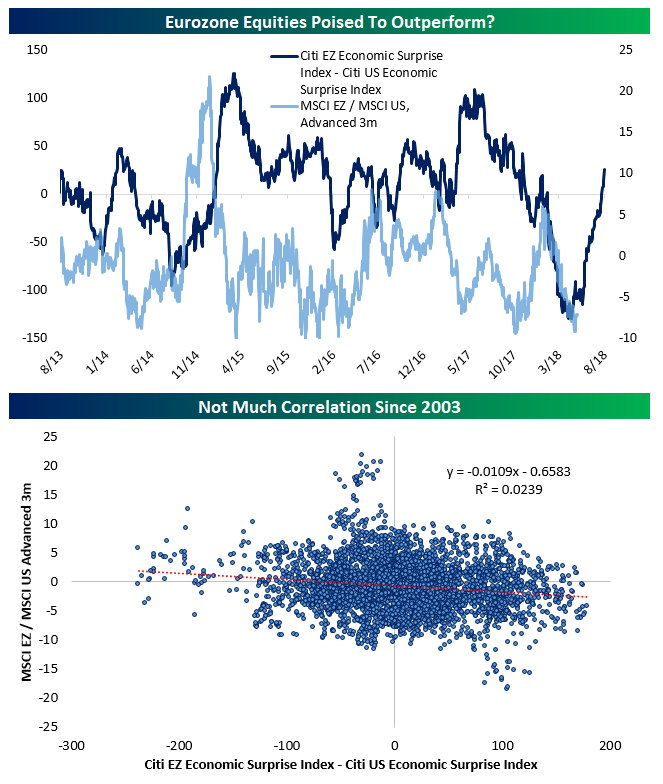

Recently, the Citi Economic Surprise Index for the Eurozone has started to improve while the Citi Economic Surprise Index for the US has slipped into negative territory. As shown in the first chart below, we show the relative surge in Eurozone data surprise versus the US. Historically, that’s had a relatively mixed message for relative equity performance. As shown in the chart below, forward returns are at times correlated and at times uncorrelated to the relative performance of Eurozone versus US equities. But the bottom line is that longer-run, relative economic surprise index performance is basically uncorrelated to forward performance; we show the long-run lack of correlation in the bottom chart below.

Leave A Comment