Economists are right in line with Fed theory that weakness is transitory.

Economists are not eyeing a second-half recovery. Rather, they expect a strong second-quarter recovery in the range of 3% to 4% according to the Wall Street Journal.

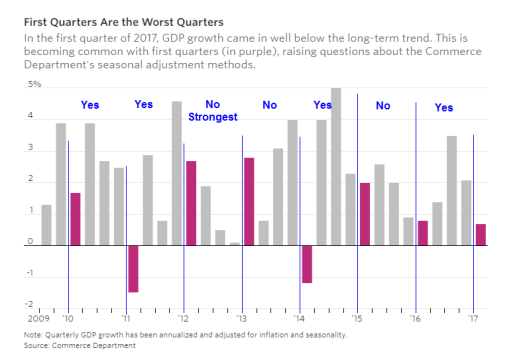

Are the first quarters the worst quarters?

The main factor behind the latest slowdown: Sluggish consumer spending. Household outlays grew by the smallest amount since late 2009, as Americans reduced purchases of big-ticket items like cars and spent less on home heating during the warm winter. Rising inflation also cut into Americans’ paychecks.

The slowdown contrasted with surveys showing surging confidence among Americans and the booming stock market. And it offset other positive developments, including a pickup in business investment and a rise in U.S. exports.

Economic output often varies widely quarter to quarter, and most economists expect the economy to rebound to a rate of between 3% and 4% growth this spring. Indeed, the economy has a habit of starting the calendar year off sluggishly and strengthening later on.

Some economists point to possible flaws in the government’s methods for adjusting its data to account for seasonal factors. And temporary factors may have weighed on growth early this year, including unusually warm weather that led to lower utility use and a delay in households receiving tax refunds.

Seasonal Adjustments Wrong?

On July 29, 2016, Bloomberg reported First-Quarter U.S Growth Potholes Less Cavernous, Revisions Show.

Persistent first-quarter weakness in recent years had sparked a debate about these statistical quirks, prompting government agencies to revamp the process of smoothing discrepancies.

“We’ve made great progress on refining our seasonal-adjustment process,” Brian Moyer, director at the Commerce Department’s Bureau of Economic Analysis, told reporters in Washington this week.

Even with the tweaks, growth at the start of the each year remains weaker than in other quarters on average, suggesting some residual seasonality may remain. The BEA plans to fully incorporate fixes to the adjustment process by 2018.

The BEA was unable to say definitively whether the general improvement in first quarters was caused by the changes to the seasonal adjustment or reflected better source data that feed into the GDP calculations, Brent Moulton, associate director for national economic accounts at BEA, said at the press conference.

“It’s difficult to separate,” he said. For the entire period dating back to 2013, “these revisions are relatively modest.”

One cautionary note is that the new breakdown shows a more pronounced slowdown in the economy heading into 2016. The year-over-year growth rate cooled from 3.3 percent in last year’s first quarter to 1.9 percent in the final three months of 2015, rather than the previous downshift from 2.9 percent to 2 percent.

The pattern of upward revisions to first-quarter data was broken this year, with the growth rate in the first three months of 2016 revised down to 0.8 percent from a prior estimate of 1.1 percent.

Leave A Comment