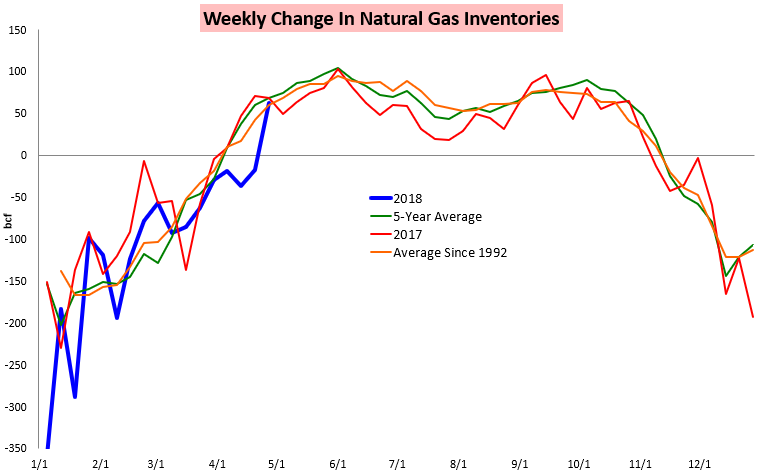

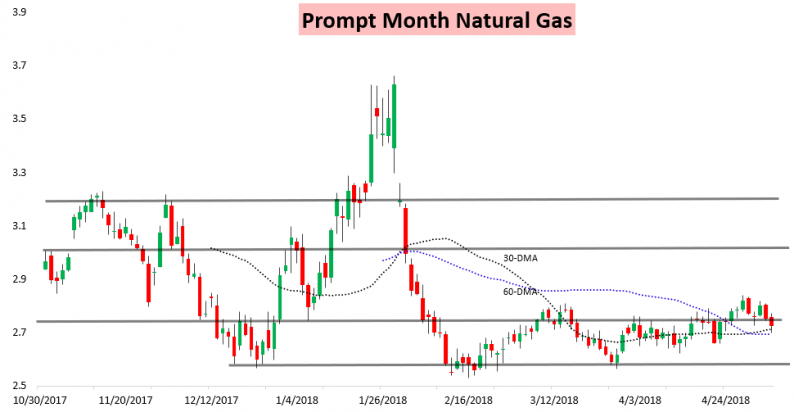

After three straight bullish EIA prints the last three weeks, today’s release missed on the bearish side of expectations as the EIA reported a larger injection of gas into storage last week than expected. The result was a continuation of morning declines in the prompt month June natural gas contract, and though prices weakly recovered into the close they still settled down around a percent on the day.

Prices did creep higher this afternoon into the settle, with the prompt month contract recovering the most. The end result was the fall strip generally lagging the most on the day.

As a result, the June/July M/N natural gas spread had its most narrow settle since early January despite declines along the strip.

This decline fell right in line with expectations, as in our Morning Update on Monday we called for prices to move towards the $2.7-$2.72 level.

Then our Afternoon Update yesterday affirmed that prices should move into this $2.7-$2.72 range today, with the June contract bottoming today at exactly the $2.700 tick.

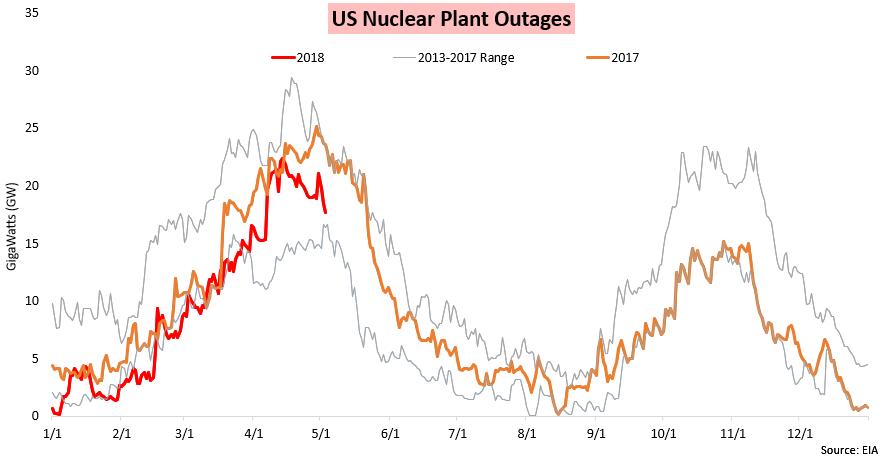

Part of the loosening mentioned in the above report summary is driven by nuclear outages, which have ticked down significantly the last few days. Increased nuclear power generation indicates less natural gas burned for power generation, which appears to be one factor that has helped loosen the market over the past week.

Today’s EIA data sent natural gas prices immediately to the lows of the day, as the EIA announced that last week 62 bcf of natural gas was injected into storage as opposed to our estimate of 52 bcf.

We saw this as an implicit revision of the print last week, as last week we were 11 bcf too small on the withdrawal and this week 10 bcf too small on the injection, a net difference of just 1 bcf between the two weeks. Estimates were quite wide with the print due to how many fewer GWDDs comprised the last gas week.

Traders now head into the last trading day of the week weighing this recent EIA data with some rather recent weather forecast changes that we have been tracking for subscribers the last couple of days (and which seemed to help move prices today as well). In our Afternoon Update, we broke down our latest reading of supply/demand balance and the relative weakness of the fall and winter natural gas strips today to explain where we saw price risk skewed into next week. We similarly expect the weather to play an increasingly important role in price action as we move through May, making our weather-driven angle all the more important.

Leave A Comment