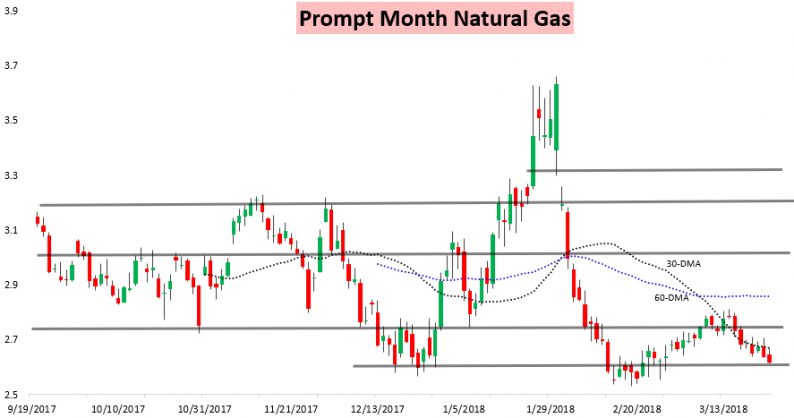

It was another EIA disapointment for natural gas, as the market crept up ahead of the data and sold off on the release that generally hit expectations, settling down slightly on the day.

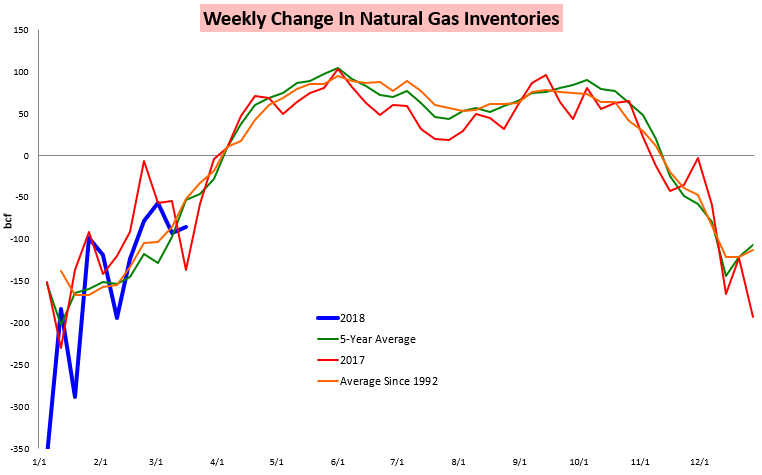

The EIA announced that last week we drew 86 bcf of gas from storage, which was 2 bcf less than our 88 bcf withdrawal estimate. This was a decently larger draw than the 5-year average but not as large as what we saw last year.

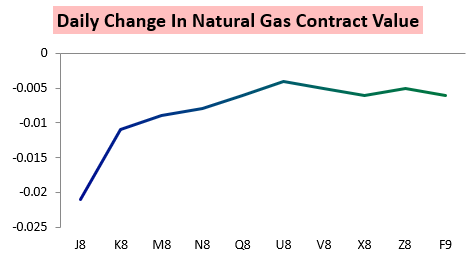

The print hit the front of the natural gas strip the hardest, with the April contract seeing the largest losses on the day.

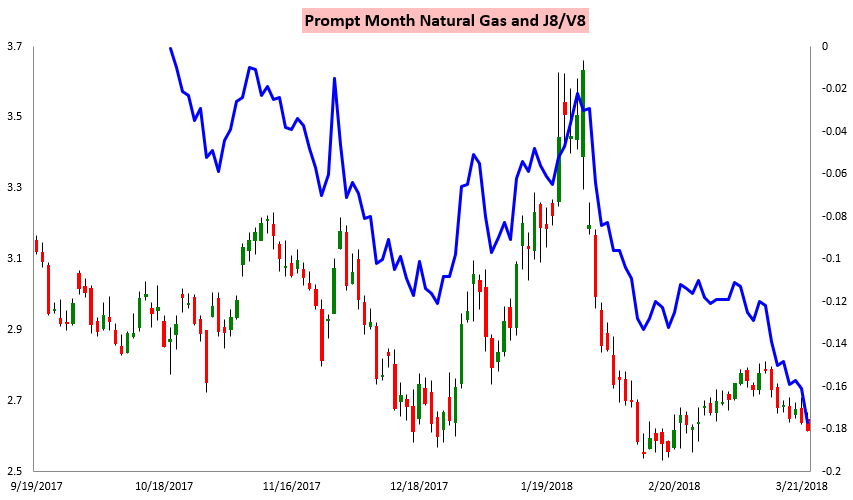

Accordingly, J/V ticked to new lows as well.

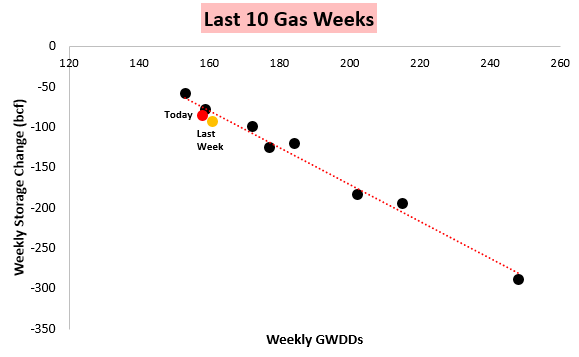

The print generally fit with expectations, though, as it showed a slightly smaller storage withdrawal than last week with just a few fewer GWDDs on the week.

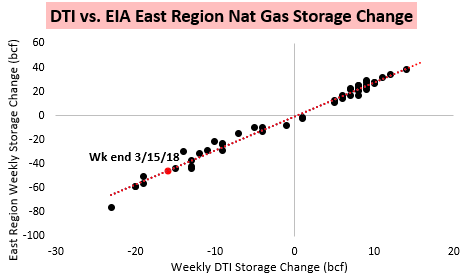

We similarly saw strong predictive power from the Dominion weekly storage number on Monday, which we were able to extrapolate to the East Region’s weekly storage change.

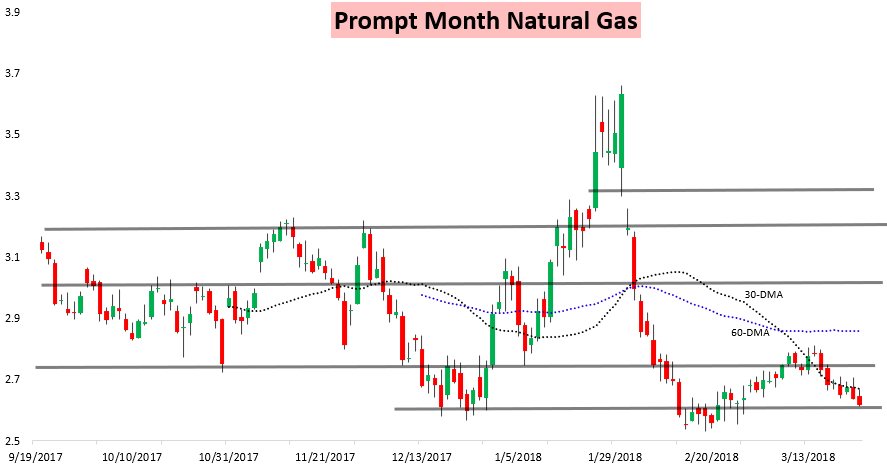

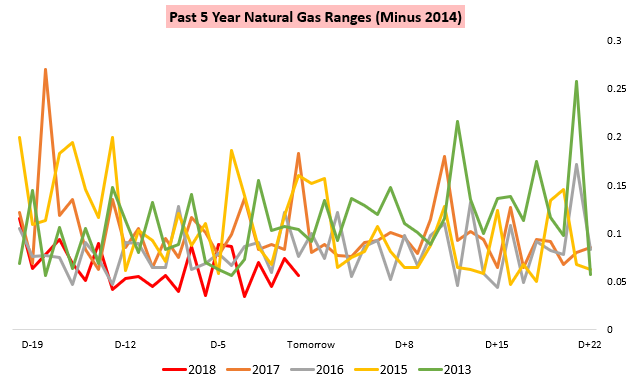

Even so, some of these moves remain noise as natural gas prices continue to see smaller overall daily ranges smaller than we are used to seeing this time of year.

Into the weekend then traders will be looking to see whether burns or demand should tick up any more, while they continue watching production closely as well (as has been a dominant theme for quite a while in the natural gas market).

Leave A Comment