It was another EIA Thursday for natural gas, and yet again the print missed expectations in a bearish manner and sent prices decently lower on the day.

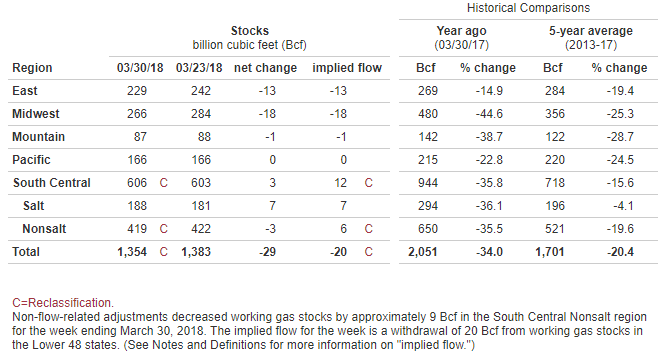

Yet the print wasn’t as straightforward as the last couple. The EIA reported a net implied flow of -20 bcf last week, which indicates that 20 bcf of gas was pulled from storage nationally. However, they also reclassified 9 bcf of gas in “non-flow-related-adjustments,” indicating that gas that was previously thought to be working gas and available for consumption is not. This depleted stockpiles by another 9 bcf week-over-week, and resulted in a net weekly change from storage of -29 bcf.

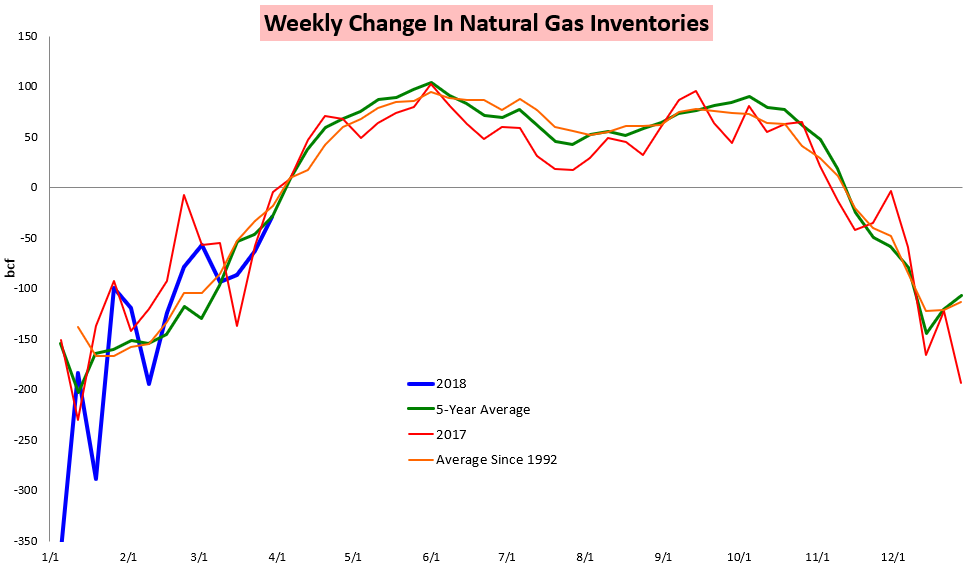

When looking at it as a net change of -29 bcf it was a larger draw than the 5-year average of a net change of -28 bcf, though the net implied flow was a smaller storage withdrawal than the 5-year average.

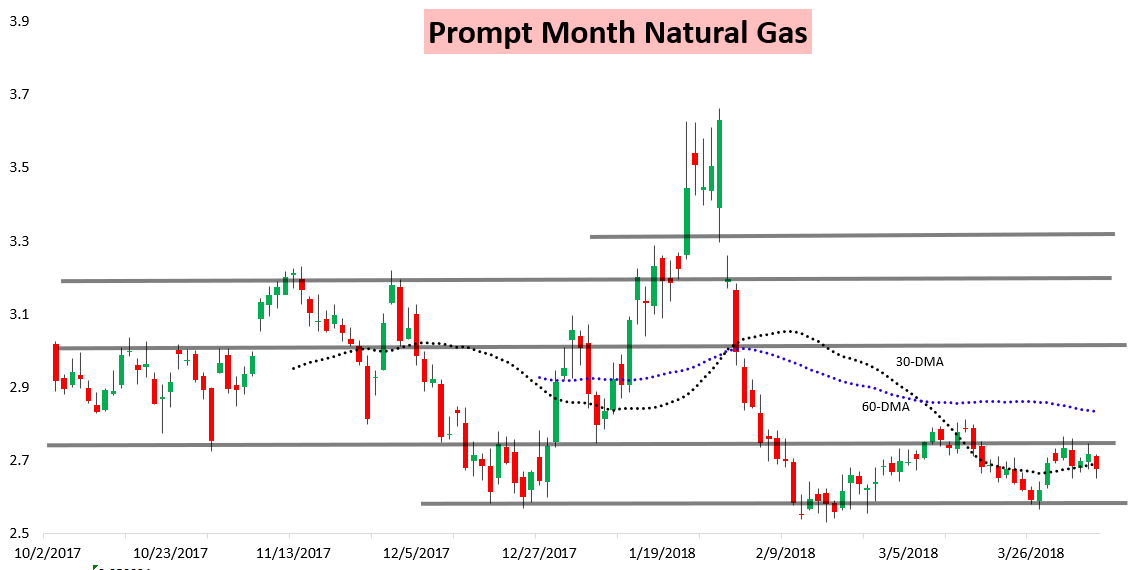

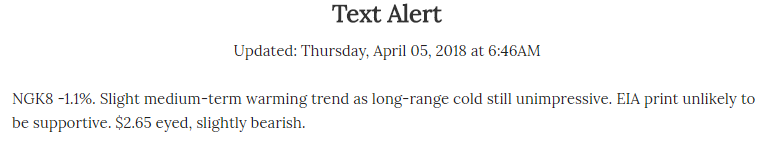

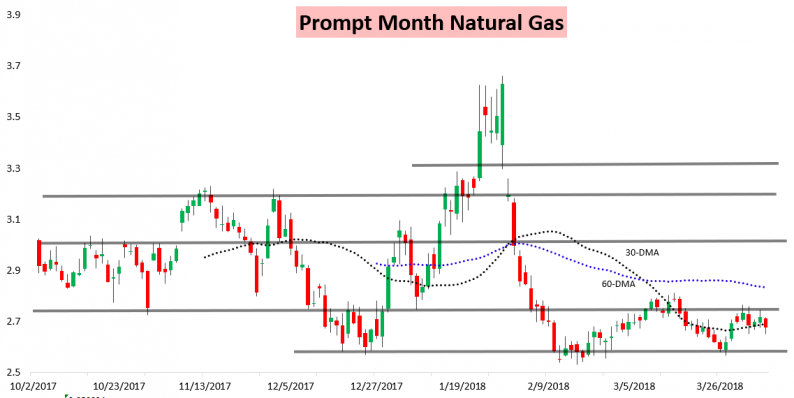

The market could tell the difference right away and dropped off the loose -20 bcf print to the $2.651 support level. This was the exact level we alerted clients this morning to watch for in our Morning Text Message Alert.

This came after we adjusted our sentiment to slightly bearish yesterday afternoon ahead of this Afternoon Update, alerting clients to watch for a pullback of up to 10 cents to the $2.65 level from recent highs.

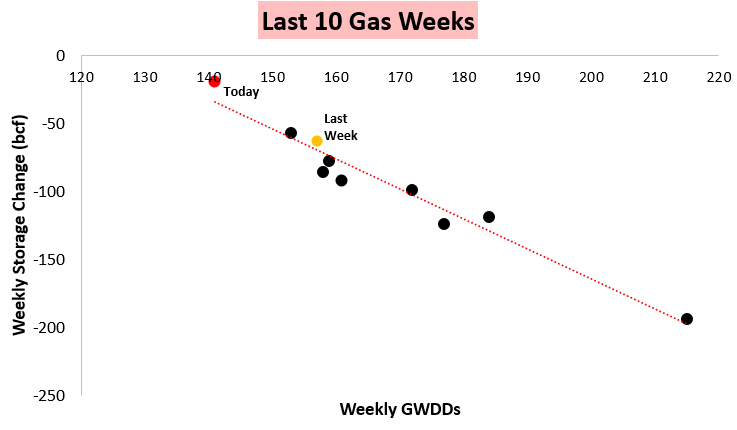

Sure enough, the EIA print was unimpressive, and when looking at the -20 bcf print it stands out from the last few weeks.

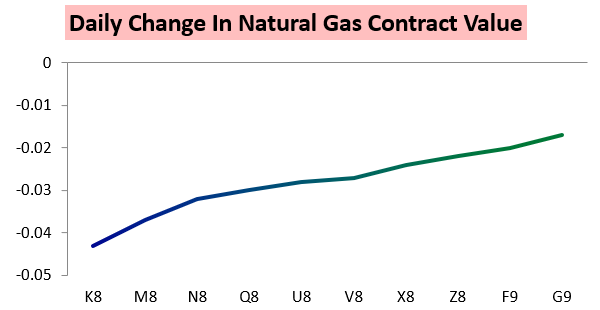

It seemed to hit the front of the strip the most too, with the prompt May contract logging the largest loss on the day.

Traders now look to digest this EIA print and the latest afternoon adjustments to the weather forecasts into the trading day tomorrow, where they will also need to position ahead of a weekend with significant short-term cold.

Leave A Comment