For much of 2017, hedge funds – most of which again underperformed both their benchmark and the broader market – complained that they were not generating alpha for one reason: there was no volatility. Well, they got their wish in spades last month when after months of record low, single-digit VIX, equity vol exploded resulting in a 3.9% slide in the S&P 500 and as 10-year yields backing up.

And so with volatility spiking, and what every commentator saying it was a “stockpicker’s market” hedge funds surely had a blockbuster month, right?

Well, no, quite the opposite in fact: according to the Bloomberg Hedge Fund database, in February hedge funds posted an overall drop of 2.19%, wiping out all of January’s gains, and leaving them flat for the year. Yes, somehow the month that all hedge funds were waiting for lead to widescale losses and last month ended up being the worst month for hedge funds since January 2016, when they slumped 2.57%.

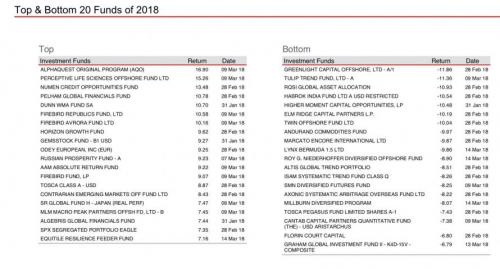

Furthermore, as we noted two weeks ago, when looking at the breakdown of specific names at the top and bottom, one stood out: David Einhorn’s Greenlight was down 11.86% as of Feb. 28, making it the worst performing hedge fund in the entire HSBC Universe.

We also flagged another problem: back on March 19 we noted that if the recent tech selloff accelerates, it would be a hedge fund bloodbath, because as we showed then, noted two weeks ago, with 4 of the 5 most widely owned names Amazon, Facebook, Google and Microsoft.

We also hinted that such a tech wreck may actually be beneficial to Einhorn, who famously has a big tech-heavy “bubble basket” and which has – until recently – crushed his performance.

Well, we were right about one thing: as of Friday, the HFRX Global Hedge Fund Index had dropped to the lowest level in 2018, down 1.2% YTD, and was back to levels last seen in October 2017.

We were, however, wrong about the ongoing tech rout helping Greenlight, because according to Bloomberg, Einhorn’s main hedge fund fell another 1.9% in March, extending its loss this year to 14%.

Leave A Comment