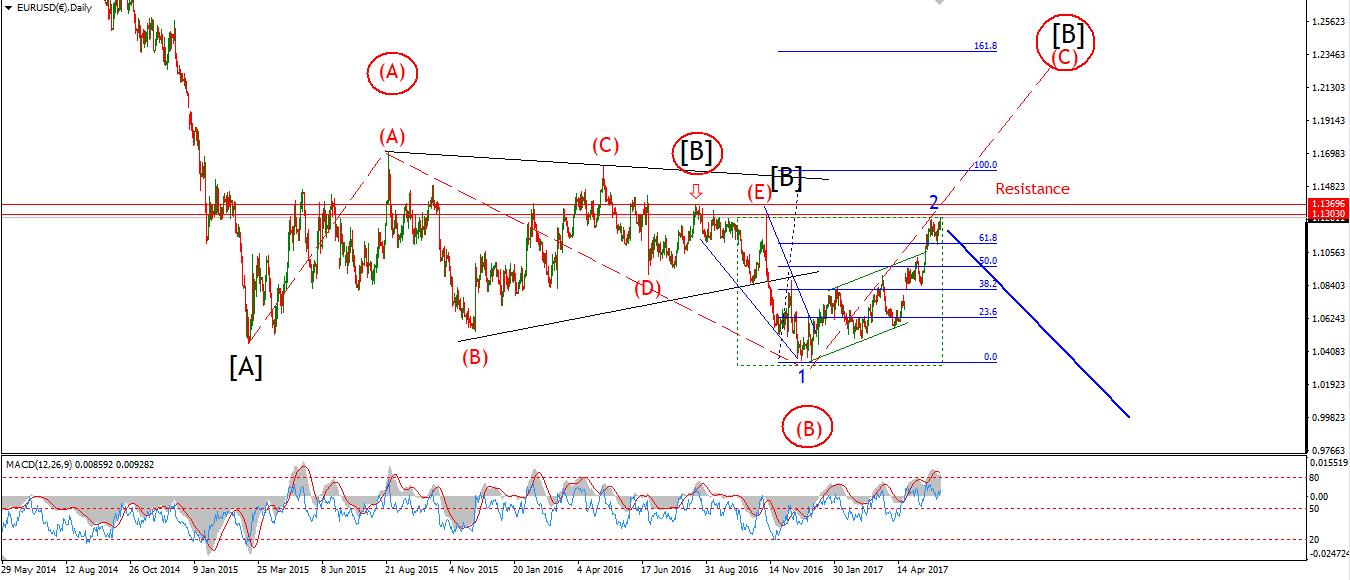

EURUSD

30 min

4 Hours

Daily

My Bias: short in wave 3 blue.

Wave Structure: downward impulse wave 1, 2 blue

Long term wave count: lower in wave 3 blue

Important risk events: EUR: N/A. USD: N/A.

Today’s action in EURUSD has not cleared up the wave count just yet. The wave count called for the price to drop in wave ‘3’ green today. Prices declined but today’s action has not developed impulsively, the price has whipsawed too much so far to make any immediate sense from it. The price is now resting at support of 1.1205. I want to see a clear break of that level, and continued declines into 1.1109 to affirm that this market has finally topped out.

From a market internals point of view. The latest C.O.T data shows traders now hold the biggest NET long position since October 2011. EURUSD stood at 1.4600 at that point, and declined from there for a solid year to a low of 1.2200 before recovering. That’s a 2400 point decline, and I am expecting something similar this time around.

For the next few trading sessions, 1.1285 forms immediate resistance, prices should not rally above that level.

A break of support at 1.1109 will switch the focus to the downside.

GBPUSD

30 min

4 Hours

Daily

My Bias: short below parity.

Wave Structure:continuing impulsive structure to the downside in wave (5)

Long term wave count: decline in wave (5) blue, below parity

Important risk events: GBP: Parliamentary Election results, Manufacturing Production m/m, Goods Trade Balance. USD: N/A.

Cable declined off the trend channel today, in the initial declines of wave (iii) brown.

This wave count calls for some pretty serious declines dead ahead.

The price has spent the last 6 weeks going absolutely nowhere. The topping process is sluggish but when cable does turn down again, it will do so with vengeance. All the while, the daily chart just registered a death cross of the moving averages. The general environment is turning ugly here for cable.

Leave A Comment