Like it or not, believe or not, accept it or not, extreme asset valuations today mean that we are still mired in the secular bear (of high capital risk, low yields and poor future return prospects) that began in 2000.

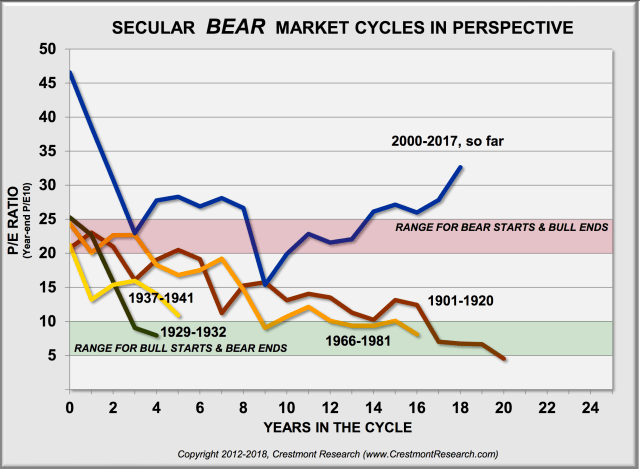

To illuminate this point, Crestmont Research has updated its secular bull and bear market cycles charts on their website here. As shown below, as in past secular bear periods,the only thing that can finally end the one we are stuck in, and restore longer term return prospects to the risk-worth-taking zone, are much lower valuations including PE ratios 10 and under (green band below), versus 30+ today. Until this mean reversion happens, present stock holders are just whistling past graveyards hoping for skill-less, blind luck to continue indefinitely.

However, the upside too rarely mentioned today, is that 18 years into this secular bear, we must be close to the end–the final mean reversion cycle that will finally restore attractive risk-return opportunities for our long-term savings once more.

For some important insight on this point, see Millennials, born under the sign of the bull, should embrace the bear:

The baby boomers entered the workforce from roughly 1966 to 1984. They couldn’t have timed it better because U.S. stocks were in an epic funk during those 19 years. The S&P 500 Index gained just 3.2 percent annually while inflation grew by 6.5 percent, which means the real value of U.S. stocks declined by a stunning 3.3 percent a year for nearly two decades…It also meant that by the time boomers entered their peak earnings years in the mid-1980s, the stage was set for the biggest market run-up on record…Millennials will soon enter their peak earnings years. They should root for recent market turmoil to turn into a long rout. And if their wish is granted, they should shovel as much money as possible into the market.

Note to boomers: we too can set ourselves up to take advantage of the next secular bull that will bring higher yields and help support us through our retirement years. But first, we have to step off the long-always bus most are currently sleeping on, build up cash savings, and patiently wait for the low prices and valuations coming out of the next bear market. Remember there can be no meaningful buying opportunity, unless we acted on selling opportunity before it.

Leave A Comment