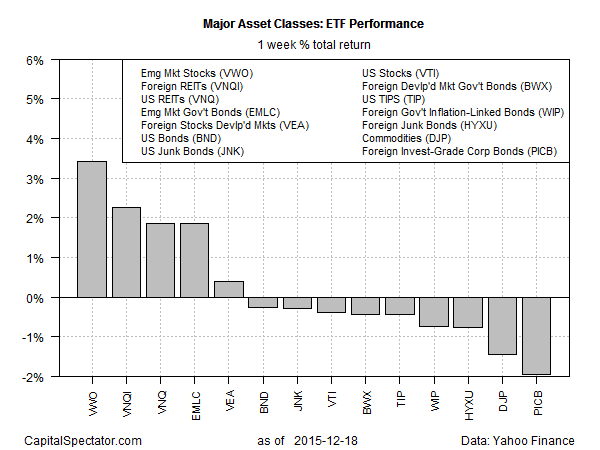

Equities in emerging markets bounced higher last week, jumping 3.4% for the five trading days through Dec. 18 via the Vanguard FTSE Emerging Markets ETF (VWO). The gain–the first weekly advance since mid-November–marks the strongest performance among the major asset classes for the week just passed, based on a set of proxy funds.

Although last week’s rally in emerging-market equities offers welcome relief from the selling in recent history, the case is still weak for seeing the latest pop as the foundation for a sustained revival in this battered corner. VWO’s momentum remains deeply negative. Even after last week’s rise, the ETF’s price is well below its 50-day moving average, which is deeply below its 200-day average.

Last week’s big loser: foreign corporate bonds. The PowerShares International Corp. Bond ETF (PICB) tumbled nearly 2%, more than reversing the previous week’s increase that put the fund at the top of the weekly leader list as of Dec.11.

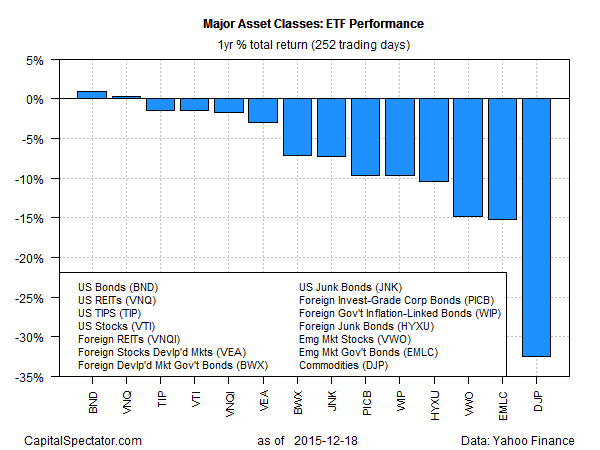

Meanwhile, the longer-term profile for markets continues to wallow in red ink. The two exceptions: US investment-grade bonds (BND) and US REITs (VNQ), which are posting small gains for the trailing one-year period through Dec. 18. Otherwise, the major asset classes are nursing various degrees of loss, led by the steep decline in a broadly defined commodities portfolio (DJP), which is off by roughly one-third for the 12 months through last week’s close.

Leave A Comment