(from my colleague Dr. Win Thin)

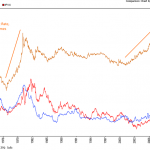

Risk sentiment ended last week on a strong note, and that should carry over into this week. The global liquidity backdrop remains positive for EM, with the ECB widely expected to add more stimulus on Thursday. In a similar vein, the Fed is widely expected to remain on hold until June.

China is doing its part to prevent negative market impact from developments there, including reports of intervening to support the equity markets last week. Lastly, commodities remain bid and WTI oil made a convincing break above $35. All told, these conditions appear sufficient to keep the EM rally going for now.

Some idiosyncratic risks remain, though in Brazil’s case, there are potential positive developments in the political landscape. The Bank of Israel reportedly intervened aggressively to limit shekel gains last Friday. And similar to S&P’s move last month, Moody’s put several oil producing nations on notice for downgrade risk with cuts to their outlook.

Taiwan reports February trade Monday. Exports are expected at -11.8% y/y and imports at -8.4% y/y. It then reports February CPITuesday, which is expected to rise 0.9% y/y vs. 0.8% in January. With the economy contracting and inflation risks low, the central bank is likely to continue easing this year. Next policy meeting is March 24, and a 25 bp cut then is possible.

Hungary reports January IP Monday, which is expected to rise 5.7% y/y vs. 6.9% in December. It then reports February CPITuesday, which is expected to rise 0.5% y/y vs. 0.9% in January. January trade will also be reported Tuesday, which is expected at EUR746 mln. Central bank minutes will be released Wednesday. With deflation persisting, we think further easing is being contemplated. Next meeting is March 22, but no move is seen then.

Chile reports February trade Monday. Exports are expected at -5.9% y/y and imports at -9.5% y/y. It then reports February CPITuesday, which is expected to rise 4.6% y/y vs. 4.8% in January. With inflation easing back towards the 2-4% target, the central bank may pause its tightening cycle. The last move was a 25 bp hike to 3.5% in December. Next meeting is March 17, and no move is seen then.

Leave A Comment