On Tuesday, the Empire State manufacturing region returned to positive territory following seven months of contraction.

Today, the Philadelphia Fed manufacturing region returned to positive territory following five months of contraction.

Is the worst over for manufacturing or is this simply a breather?

Let’s start with a look at the Empire State and Philadelphia Fed reports.

Empire State

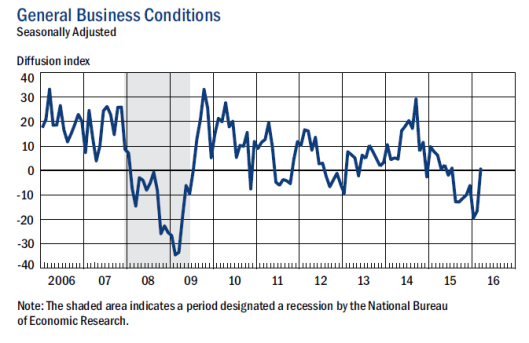

The headline general business conditions for the Empire State region climbed seventeen points to 0.6, its first positive reading since July of last year. The new orders and shipments indexes rose well above zero for the first time in several months, pointing to an increase in both orders and shipments. Labor market conditions were little changed, with employment and the average workweek holding fairly steady.

Empire State Details

That’s quite an improvement in the New York region. Let’s turn to Philadelphia.

Philly Fed Index

Philly Fed Details

Fundamental Change?

Here’s the key question: Do these reports represent a fundamental change?

I suspect not, for numerous reasons:

Leave A Comment