We have recently discussed the manufacturing sector’s problems several times, as well as the trends in employment data. As a general remark to this, it seems that the sectors that have lately contributed especially strongly to employment growth were health care and social services, leisure and hospitality and construction.

The echo boom in construction may be running out of steam . Interestingly, this is once again happening even before a rate hike cycle has begun – in a sector that traditionally benefits disproportionately from low interest rates. Data on housing starts, permits and construction are admittedly quite erratic from month to month. However, there are a number of signs that the sector may be about to cool down. Said erratic data on starts and permits have just nosedived again from what remains a historically low base.

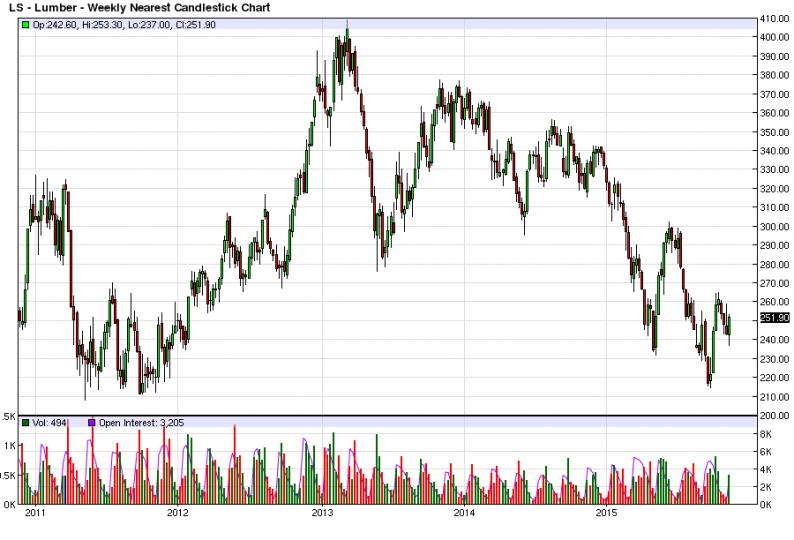

Lumber futures prices (weekly) over the past five years – click to enlarge.

A friend has also pointed us to a recent article by Tom McClellan, which discusses the message from the decline in lumber prices. We were trading bond futures and options in the 1980s, and back then everybody in the trading community seemed to be well aware of the connection between lumber prices, interest rates and the economy. However, as Mr. McClellan notes, the Federal Reserve may actually not be aware of lumber’s strong record as a leading indicator. He shows the correlation by means of a chart aligning lumber prices with housing starts, with lumber prices set forward by 10 months:

Lumber prices set forward by 10 months vs. housing starts.

Incidentally, lumber prices are also a long leading indicator of initial unemployment claims, although it seems possible that the historically still low overall level of construction employment may make this correlation less pronounced this time around. We have little doubt though that lumber prices remain a relevant leading indicator for the home building industry.

Leave A Comment