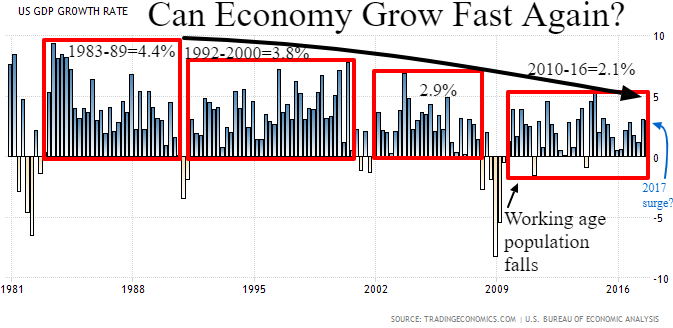

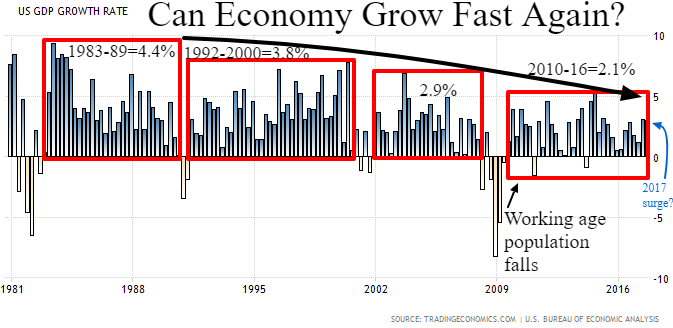

Perpetually slow growth has been the ethos of this 8 year recovery cycle. The New Normal mantra coined by PIMCO in 2009 has become ubiquitous in financial circles to distinguish this sluggish expansion cycle from all others. Our lethargic global recovery was a fait accompli for the sins of state sponsored mismanagement during the preceding decades. With all 1st world countries shifting from workaholic boomers to retiring leisure seekers, can the US reverse the receding tide of economic growth and productivity rates?

The US hit its post WWII stride as the baby boomers flooded the workforce reaching their peak earning and spending years in the 1980’s and 90’s. We became so used to the consistent 4%+ years of GDP growth that consensus has pegged the current cycle as anemic, quickly blaming Bush and Obama for the failure to achieve a “normal” recovery. The aging demographic of boomers has been a major component of shrinking interest rates and slowing economic growth over the past couple of decades. After almost 8 years of just 2.1% economic growth rates, the last 2 quarters of 3%+ growth raises the question of just what potential the US and Western World have of achieving the “old normal” growth rates.

Unfilled Job Openings are hitting record levels as both low and high skilled labor demand remains difficult to satisfy as the prime age labor force growth slows from over 1% to almost zero and unemployment nears record lows. While job openings have increased the past 2 years, hiring trends have been stagnant since late 2015. Our personal experience failing to find even unskilled machine operators in a time of renewed growth is anecdotal evidence of national trends. Handling new orders and converting heavy backlogs to timely shipments is vital to profitability and an alarming challenge for the goods producing sector.

Who’s left to fill the jobs? Even when the the labor markets were considered tighter in terms of unemployment in 2000 and 2007, we had more workers per job opening compared to today.

Leave A Comment