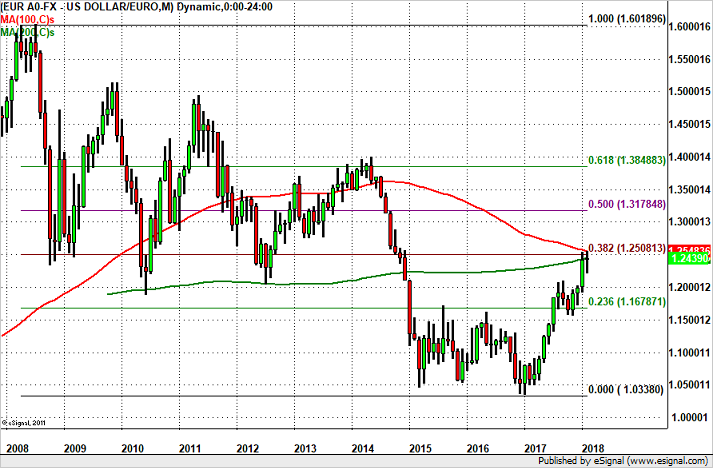

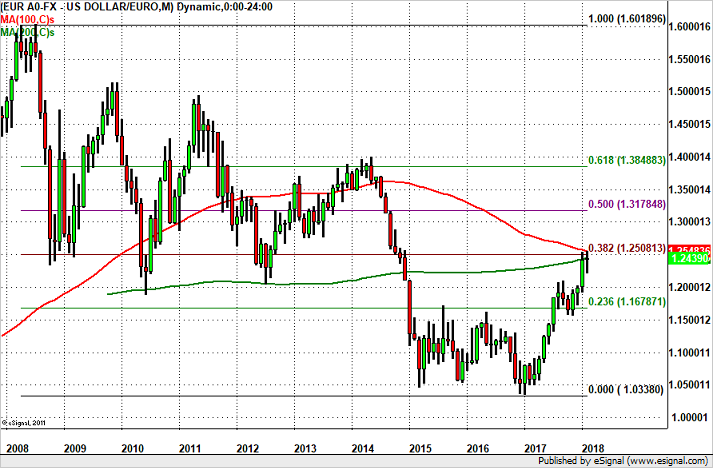

EUR/USD had a great run this past week but the sell-off on Friday screams of a deeper reversal. Technically, the rally stopped just short of the 100 and 200-month simple moving averages near 1.2550. These are significant resistance levels that would be the perfect points for reversal. Technically, we see reasons for a near-term recovery in the U.S. dollar but fundamentally there are plenty of reasons supporting the euro’s rise. The latest Eurozone economic reports show ongoing strength in the Eurozone economy. The European Central Bank is optimistic with members like Benoit Coeure saying the central bank will discuss changes to the policy language in early 2018. There’s no doubt that the positive momentum in the economy has ECB officials thinking about normalizing monetary policy and they could make the move as early as next month. This would be irrespective of how next week’s economic reports fare. EUR/USD will be in focus with a number of market-moving data scheduled for release including the ZEW survey, February PMIs, and the German IFO report. So even if EUR/USD dips, we expect buyers between 1.2250 and 1.2375.

Leave A Comment