My Swing Trading Approach

I am concerned with whether Tech will fall apart again and drag the rest of the market down with it. If that is the case, I will look at a more cautious approach to the market today.

Indicators

VIX – Surprisingly back below 10 to 9.58. I would not be surprised to see a pop in the VIX regardless of market direction.

T2108 (% of stocks trading below their 40-day moving average): 4% move to 58%.

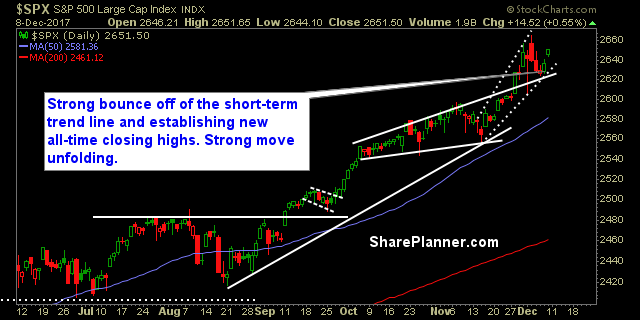

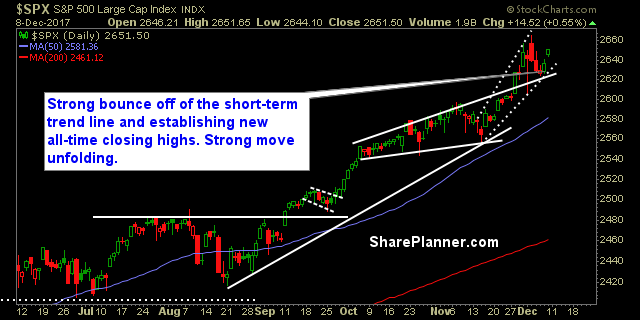

Moving averages (SPX): Currently trading above all major moving averages.

Industries to Watch Today

All the industries moved higher on Friday, lead by healthcare/biotech. Energy appears to be coiling for a bigger move. Cyclical and Defensive continue to hold strong. Financials with a bull flag, while Technology could be seeing a dead cat bounce.

My Market Sentiment

Follow through on the indices Friday. Though the Nasdaq bounce doesn’t seem as strong. Breadth is also a concern for the market at this juncture.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Recent Stock Trade Notables:

Leave A Comment