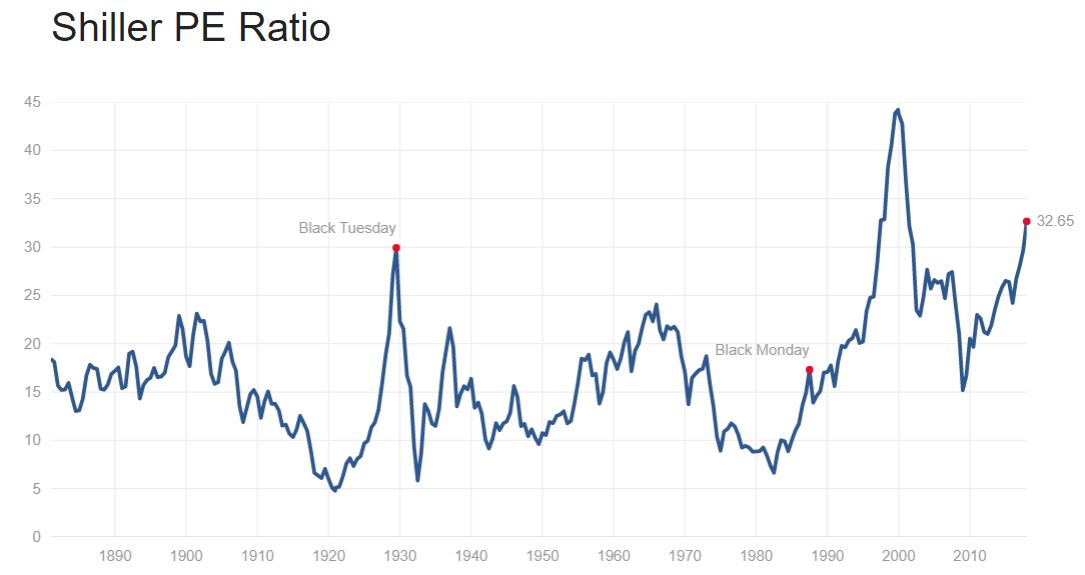

Once upon a time, the chart below would have resulted in value investors loading up on short positions, or at the very least moving money to the sidelines, while poking fun at the ‘momo’ crowd for once again convincing themselves that “this time is different” as they chased equities ever higher.

Alas, as Bloomberg points out this morning, this time around it seems that even the most famed value investors, including Jeremy Grantham, have decided to throw in the towel on their bearish bets.

“Morningstar kicked us out of their category,” said Callahan, who helps oversee $2 billion as president at Icon Advisers Inc. in Greenwood Village, Colorado, and hasn’t bet against a stock in two years. “We’re in a great bull market. This market is going higher. Why short now?”

Everyone’s got a bull case nowadays. Legendary short Marc Cohodes tells anyone who’ll listen to buy Overstock.com for its blockchain platform. Credit crisis savant Gary Shilling says deregulation is driving equities. Even Jeremy Grantham, venerated advocate of buying cheap, says it’ll be a long wait.

“Jim Grant put me in the title a few months ago under the heading of ‘The Apostasy of Jeremy Grantham,’ that I was forswearing my religion,” the 79-year-old chief investment strategist for GMO LLC in Boston said. “It’s an exaggeration, but it picks up the idea that I’ve temporarily broken ranks with the general tone of the value community.”

In fact, as Institutional Investor noted earlier this summer, Grantham has even gone so far as to suggest that this time is different and that future earnings multiples will oscillate around much higher levels going forward, rendering pre-1996 data all but irrelevant.

In his latest client letter, Jeremy Grantham, famed value investor and co-founder of $77 billion asset manager Grantham Mayo Van Otterloo & Co., makes the case that the average has shifted upward for important metrics including price-to-earnings ratios and profit margins, throwing off the historical balance used to determine market value.

“For value managers the world was, for the most part, convenient, and even easy, for decades,” he wrote. “And then it changed.”

According to Grantham, 1996 was a tipping point for investing. Since that year, price-to-earnings ratios “still oscillated the same as before,” but around a “much higher mean — 65 percent to 75 percent higher.” Profit margins have also gotten higher, with the mean over the last two decades up 30 percent compared with pre-1997 averages.

“We value investors have bored momentum investors for decades by trotting out the axiom that the four most dangerous words are, ‘This time is different,’” Grantham wrote. “For 2017 I would like, however, to add to this warning: Conversely, it can be very dangerous indeed to assume that things are never different.”

Leave A Comment