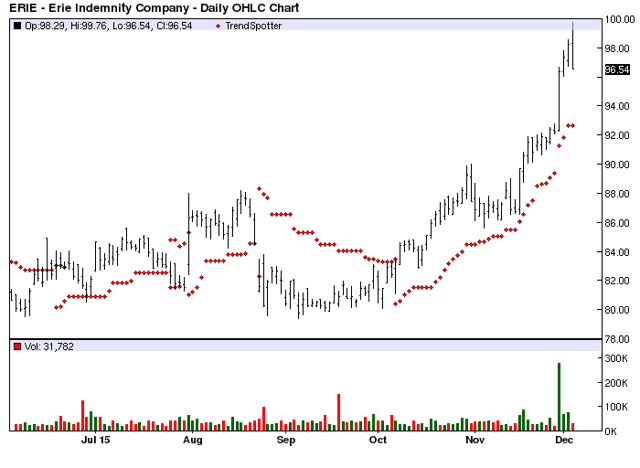

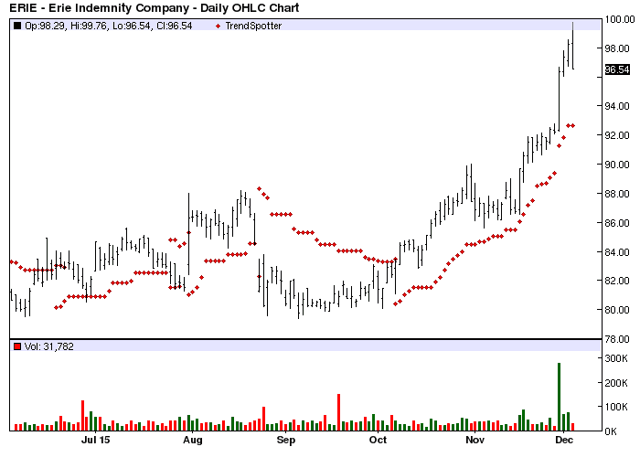

The Chart of the Day belongs to Erie Indemnity (NASDAQ:ERIE). I found the insurance brokerage stock by using Barchart to sort the Russell 3000 Indexstocks first for the highest number of new highs in the last 20 trading sessions, then I used the Flipchart feature to review the charts. Since the Trend Spotter signaled a buy on 10/7 the stock gained 16.10%.

Erie Indemnity Company’s principal business activity consists of management of the affairs for Erie Insurance Exchange. The company also participates in the property/casualty insurance business through its three wholly owned subsidiaries, Erie Insurance Company, Erie Insurance Company of New York, and Erie Insurance Property and Casualty Company and through its management of the Flagship City Insurance Company, a subsidiary of Erie Insurance Exchange.

The status of Barchart’s Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Brahcrat technical indicators:

Fundamental factors:

The 50-100 Day MACD Oscillator has been a reliable technical trading strategy for this stock.

Leave A Comment