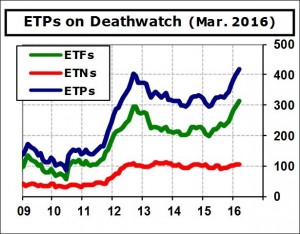

The quantity of funds on ETF Deathwatch surged by 20 this month, establishing a new record high. With 28 new names joining the list and just eight leaving, the membership roll now has 418 entries and easily surpasses the previous record of 403 set in September 2012. On a percentage basis, one can make the argument that the industry is healthier today than it was in 2012. Indeed, the 403 funds on ETF Deathwatch at the previous peak represented 27.3% of the 1,474 listings at the time. This month’s 418 members of ETF Deathwatch account for “only” 22.4% of the 1,863 active listings at the end of February. However, it appears the current upswing has a long way to go, and the previous 27.3% could eventually be surpassed too.

Launching a successful ETF in today’s environment is tough. For starters, the world needs to know that you have a new product. With new ETFs being launched every week, that might be tougher than it sounds, because your press release is likely to get lost in the noise. If you get past that hurdle, then you must be able to articulate what sets your product apart from the more than 1,800 other choices available to U.S. ETF investors. All of the easily definable categories are covered, and some categories that proved to be successful for the first movers are now overrun with me-too products.

Does the world need another dividend ETF? ETF sponsors seem to think so and rolled out 58 additional ones in 2015. What makes these any different or better than the dividend ETFs that came before? Generally, the answer is “very little,” but that doesn’t stop firms from trying. There are too many dividend ETFs, more than the market can absorb, resulting in more and more showing up on Deathwatch every month.

Back in August, O’Shares, a relatively new ETF sponsor run by Kevin O’Leary of Shark Tank fame, expanded its lineup with four new dividend ETFs. Today, all four join ETF Deathwatch. On Shark Tank, Mr. O’Leary claims to be interested in only one thing—making money. The four O’Shares ETFs joining ETF Deathwatch this month have less than $5 million in assets on average. They are not “making money” today, and it is not clear how long they will be subsidized. For now, these four O’Shares ETFs are dead to me.

Leave A Comment