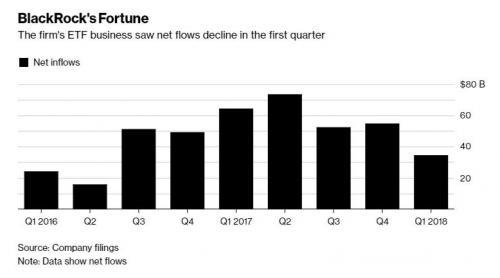

If ETF inflows are supposed to be some type of strong foundation for the market to rest on, Blackrock’s latest quarterly earnings report should be a sign that the bottom could be ready to fall out. The world’s largest asset manager saw its ETF inflows fall 46% in the first quarter from the year prior. Aside from being a shaky indicator for the market in general, this is also expected to put pressure on Blackrock’s top line going forward. Bloomberg saw its ETF inflows fall 46%:

Even as BlackRock Inc.’s growth appears unstoppable, there are signs the firm isn’t invincible.

The world’s largest money manager saw net flows for its global iShares exchange-traded funds decline 46 percent in the first quarter to $34.6 billion from a year earlier. Even with the fall in flows, BlackRock beat quarterly earnings estimates and saw total assets under management rise to $6.3 trillion.

Choppy markets spurred traders to devote less cash to ETFs. And with good reason given that the S&P 500 index ended the quarter down 0.76 percent. ETFs charging 0.2 percent or less have accounted for 82 percent of the industry’s net flows this year, up from 77 percent in the fourth quarter, according to research from Bloomberg Intelligence.

In “data that is alarming that the financial media will likely ignore” news this morning, market volatility has prompted investors to hold off on investing in ETFs at BlackRock, which saw its iShares exchange traded funds fall to $34.6 billion from the year prior. Over the last several months, ETFs have experienced significant volatility in flows as evidenced by the stunning chart below showing how inflows have almost instantly dried up as soon as the market volatility in February started.

Going forward, the picture doesn’t seem to be getting any rosier. A saw its ETF inflows fall 46% out this morning quotes an Edward Jones analyst as saying:

“Sustaining [ETF] growth at double-digits in terms of asset flows will be really tough to do” for BlackRock, said Kyle Sanders, an analyst at Edward Jones & Co.

Leave A Comment