In the early days of Etsy a site sprang up called Regretsy that made me (and many others) laugh to the point of tears. Their tagline was “where DIY meets WTF” and it was simple but brilliant. They would find tragically bad works on Etsy and share them with a brief comment. At first, Etsy members were upset about it. But then they discovered that the traffic from Regretsy was helping them, and they learned to tolerate if not love it.

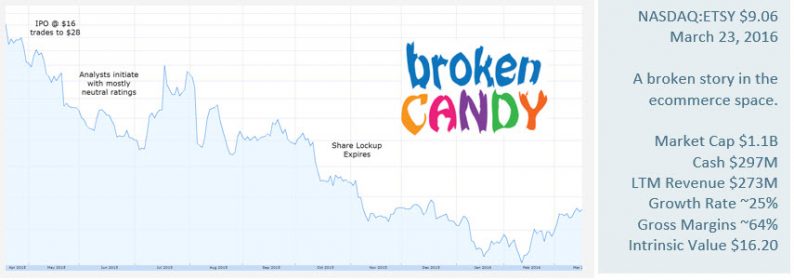

Page ahead to the Etsy IPO and what had been a joke was presented an institutional investment as the category leader in the “craft ecommerce” space. It was a hot IPO with the rare combination of both Goldman Sachs and Morgan Stanley as lead underwriters.

All the trends seemed to be in Etsy’s favor including:

Growth in freelancing and the so-called “gig” economy

Continuing spread of online commerce to businesses and consumers

Trend towards more local sources and smaller producers

Easier commerce across nations and geography

Much of Etsy’s traffic growth has been organic rather than paid for

Some of the key thrusts in their messaging was about creating “a person to person” economy and building an “authentic, trusted marketplace.”

We published a note on Etsy back at the time of the IPO in April of 2015. (See our full post “Can Etsy Survive an IPO” for all of it) but here are some useful snippets:

The IPO itself is a major event and brings in a whole new facet of “community” in the form of investors who may, in fact, care much more about sales and profits then relationships, creating social good and long-term thinking.

Etsy has made a major shift from organic, word-of-mouth-driven growth to a more traditional method of spending heavily on marketing. For example, they doubled marketing spending from 17.9M in 2013 to 39.7M in 2014. As a percentage of revenue, marketing went from 14% in 2013 to 20% in 2014.

Long-term financial goals call for gross margins to decline 10 points from the current 62% to 50-52%as a result of growth in revenue from new value-added services. Besides going in the wrong direction these revenues more typically boost rather than wilt gross margins. There is something wrong with that picture in our eyes.

The user population is still quite narrow. There are 1.4M active sellers and 19.8M active buyers on the platform today. The vast majority, over 80% are women. Although they don’t talk about it much in the roadshow, a large portion of the Etsy business is related to selling craft supplies (like a Michael’s Stores) and Jewelry. Etsy is diversified, but even so the site has not shifted their demographic profile much in the past several years. For Etsy “active” means activity within a 12-month period.

Scale may be difficult. How large can the Etsy platform be and retain the hand-crafted and vintage sensibilities that sellers and buyers identify with? There’s more to it than simple supply and demand. As the number of discrete items and customers grows it gets difficult to find and filter products. In the same way, your local craft shop can’t “scale up” and retain the same feel and identity. Etsy may be planning to use M&A to create more of a “federation of small platforms” but this carries risks as well, and so far management hasn’t said they would go in this direction. (Although they have made a couple of small acquisitions like Grand Street and A Little Market.)

Leave A Comment