Brussels Alters Capital Requirements to “Spur Lending”

Saints preserve us, the central planners in Brussels are giving birth to new inflationist ideas. Apparently the 2008 crisis wasn’t enough of a wake-up call. It should be clear by now even to the densest observers that a fractionally reserved banking system that flagrantly over-trades its capital is prone to collapse when the tide is going out. 2008 was really nothing but a brief reminder of this fact.

The political and bureaucratic classes will certainly never go back to sound money or free banking. The State’s paws will remain firmly embedded in the business of money, as the modern-day welfare/warfare states and the ever-growing hordes of cronies and zombies they have to keep well-fed have become utterly dependent on fiat money inflation. This will continue until the bitter end. New measures are now being designed to hasten its arrival.

Designed by Bjarke Ingels

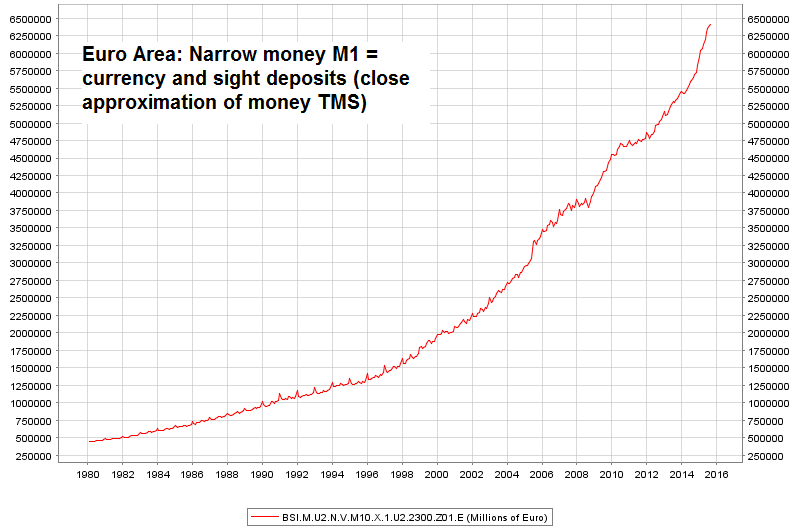

Before we continue, ask yourself if the euro zone actually needs more monetary inflation – even from the perspective of those who erroneously believe inflation to be an economic panacea:

Click on picture to enlarge

The euro area’s money supply over time. We are on purpose using the narrow aggregate M1, which is the closest approximation to money TMS. The broader aggregates include items that are actually not money, but credit transactions. This leads to double-counting. Money= the means of final payment for goods and services in the economy, via ECB

It is fair to say that this expansion of the money supply hasn’t made society at large any more prosperous; quite the contrary in fact. It has however been beneficial to the State and others with first dibs on newly created money, as real wealth has been redistributed to these privileged groups.

One of the good things to emerge from the 2008 crisis was an almost complete halt to the issuance of additional fiduciary media by European banks over subsequent years. In other words, they temporarily stopped their inflationary lending, thus creating an opportunity for the liquidation of malinvested capital, which was deprived of oxygen as a result.

In several euro zone countries this has indeed happened, but the associated economic downturn has been needlessly aggravated by the ruling class doing whatever it took to keep the size of the State and its bureaucracies at the previous level even while the private sector imploded. Our guess at this point is that nothing short of a complete collapse will be able to change this. As long as there are still sheep that can be sheared (this is how the ruling class sees wealth creators, by and large), the Potemkin village will remain standing.

Leave A Comment