EU Session Bullet Report – Bye Bye Euro

Christmas came early for those who bought the USD after Mario Draghi dropped the bomb on the EUR. Yesterday, the ECB President hinted further easing to revive the struggling EU economy. Among those measures, was another deposit rate cut which was out of the question before this meeting. As a result, the market perceived this to be hugely EUR negative and sold the common currency to even 1.1070 lows overnight from 1.1340. The news also sent global equities higher, with DAX and CAC trading up +2%, same as Nikkei and Dow Jones. The dovish ECB stand sent commodity currencies such as AUD, CAD, and NZD surging versus USD, although commodities were quite steady with OIL and GOLD trading around 45.50 and 1170 respectively.

Today’s focus shifts to the EU and US PMI’s with special focus given on technical levels (support and resistances) for EURUSD. The pair has immediate support at 1.1075 and 1.1020 and resistance at 1.1185.

Trading Quote of the Day:

“Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. Believe me, it will be enough.”

Mario Draghi

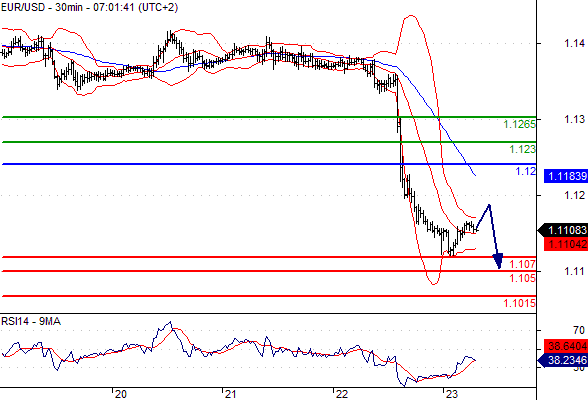

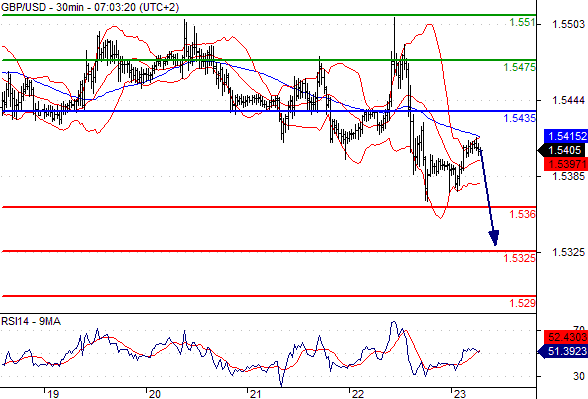

Green lines are resistance, Red lines are support

EURUSD

Pivot: 1.12

Likely scenario: Short positions below 1.12 with targets @ 1.107 & 1.105 in extension.

Alternative scenario: Above 1.12 look for further upside with 1.123 & 1.1265 as targets.

Comment: The RSI is mixed to bearish.

GBPUSD

Pivot: 1.5435

Likely scenario: Short positions below 1.5435 with targets @ 1.536 & 1.5325 in extension.

Alternative scenario: Above 1.5435 look for further upside with 1.5475 & 1.551 as targets.

Comment: As long as the resistance at 1.5435 is not surpassed, the risk of the break below 1.536 remains high.

AUDUSD

Pivot: 0.7195

Likely scenario: Long positions above 0.7195 with targets @ 0.7275 & 0.7305 in extension.

Alternative scenario: Below 0.7195 look for further downside with 0.716 & 0.713 as targets.

Comment: The RSI is supported by a rising trend line.

Leave A Comment