EU Session Bullet Report

Continued market selloff in Asia yesterday but also today (Nikkei -4.05)%, fueled by another round of negative Chinese trade data in combination with mixed messages from FED members as to a rates increase, sent the EURUSD soaring and commodities plunging. Meanwhile, Fed Chairwoman Yellen’s speech due tomorrow is eagerly awaited.

The risk aversion mode was created by news that Chinese industrial company’s profits fell to their lowest rate in 4 years, sparking fresh fears about the country’s strength. Wall Street indices were also sold off with S&P hitting a one month-low. Commodity currencies such as AUD/USD and USD/CAD suffered on the back of this as they are both countries that rely on Chinese demand.

In commodities, weak Chinese data was also the culprit that sent GOLD tumbling to 1126 from 1148 and oil to 44.40 as both commodities depend heavily on China.

Later in the day, German CPI will be closely watched for further clues on the major while US consumer confidence data will be key for the USD moves.

Trading quote of the day:

“Vision without action is a daydream. Action without vision is a nightmare.”

– Japanese proverb

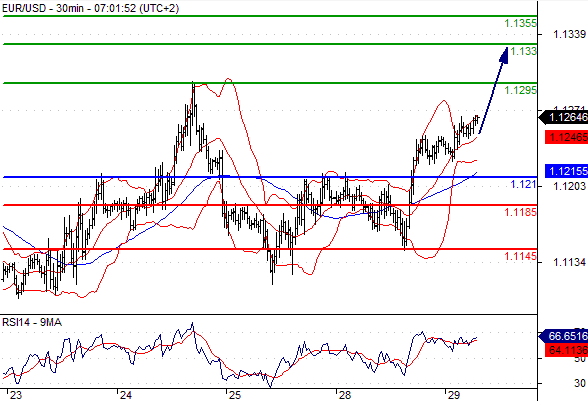

EUR/USD

Pivot: 1.121

Likely scenario: Long positions above 1.121 with targets @ 1.1295 & 1.133 in extension.

Alternative scenario: Below 1.121 look for further downside with 1.1185 & 1.1145 as targets.

Comment: The RSI is bullish and calls for further upside.

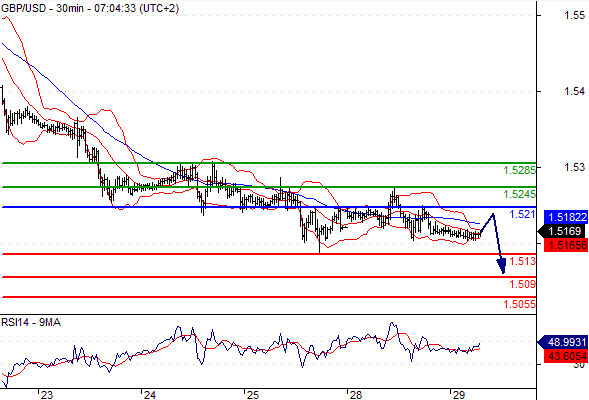

GBP/USD

Pivot: 1.521

Likely scenario: Short positions below 1.521 with targets @ 1.513 & 1.509 in extension.

Alternative scenario: Above 1.521 look for further upside with 1.5245 & 1.5285 as targets.

Comment: The RSI lacks upward momentum.

AUD/USD

Pivot: 0.701

Likely scenario: Short positions below 0.701 with targets @ 0.6935 & 0.69 in extension.

Alternative scenario: Above 0.701 look for further upside with 0.7035 & 0.706 as targets.

Comment: A break below 0.6935 would trigger a drop towards 0.69.

Leave A Comment